OCBC Bank

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912.

See below for the Latest OCBC Bank News, Analysis, Profit Results, Share Price Information, and Commentary.

OCBC Bank priced $500m perpetual capital securities

It is under its US$30b global medium-term note program.

OCBC Bank priced $500m perpetual capital securities

It is under its US$30b global medium-term note program.

Over 70 firms sign up for SG’s trade data exchange platform

The participants include DBS Bank, OCBC Bank, and UOB.

SGX's new bond issuance platform to shorten settlement to 2 days

The block-chain enabled platform is an SGX-Group-Temasek digital asset venture.

STI outpaces FTSE Developed Index with 5.5% total return

DBS, OCBC, and UOB had the most impact on STI's performance.

OCBC Bank designates new human resources head

Lee Hwee Boon will assume her new post on 24 June.

MAS slaps S$330m add'l capital requirement at OCBC after phishing fiasco

The review found deficiencies in the bank’s risk mitigation and incident management.

OCBC invests S$25m to reduce carbon footprint in operations

The bank plans to retrofit its buildings with solar panels.

Exports growth to taper in Q2 due to China, Russia-Ukraine issues: OCBC

Global supply chain woes may not be resolved soon.

OCBC Bank wins Digital Banking Award for helping SMEs make collections at the Height of the Pandemic

OCBC OneCollect singled out for its role in helping SMEs continue running their businesses during the pandemic when collection became difficult.

Market Update: STI down 1.38%

Jardine Cycle & Carriage is the only firm in the green.

Big 3 banks suffer YoY declines in non-interest income in Q122

UOB posted the biggest decline at 30%.

Market update: STI up 1.23%

Two banks led the index on the last trading day before the long weekend.

OCBC reports S$1.36b net profit in Q1

Profits were 10% lower than last year, but 39% higher than Q4 2021.

OCBC SME Index: Which sectors saw improved activity in Q1?

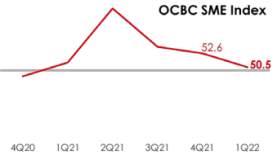

Expanding to 50.5, the index indicated improved activity amongst SMEs for the quarter.

Chart of the Day: OCBC SME Index expands for the fifth quarter in a row

This is despite contractions in the F&B, education, retail, and construction sectors.

Trading risks to weigh on Singapore Big Three Banks’ Q1 earnings: Maybank

But core businesses are expected to show resilience.

What now? Analysts lay their forecasts following Q1 GDP reveal

They still predict growth for 2022 but warn of inflation threats.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?