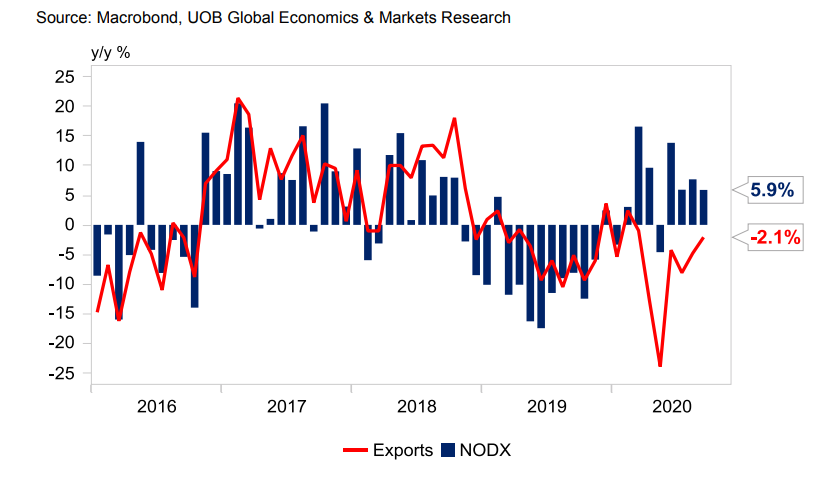

NODX sees rough growth in Q4

Singapore’s recovery momentum may take a slower and choppy pace.

NODX growth could ease further to around 2.2% YoY in Q4, which could weigh slightly on the previous forecast of around 6% YoY.

Across Singapore’s key trading partners, NODX rose in six out of 10 economies, with non-monetary gold, specialised equipment and PCs parts exports to Europe surging 60.5% YoY.

Outbound shipments to Malaysia also saw an increase of 28.8% YoY, the strongest growth pace since April 2010. Its Japan route also expanded 5.4% YoY, clocking eight straight months of positive gains.

In contrast, exports to Hong Kong continued to contract for its sixth straight month at -26.7% YoY, followed by shipments to Indonesia which fell for its seventh straight month at -16% YoY. The South Korea route also declined 5% YoY in September 2020, marking its first negative print since November 2019.

NODX should still be buoyed in Q4 by healthy NMG exports on the back of safe-haven demand, while pharmaceutical exports should revert to positive growth especially in October and November this year, given the low base prints in the previous year.

The decline in September’s pharmaceutical NODX resurfaces its volatile nature, which further injects an element of uncertainty into the overall export picture.

On the other hand, low oil prices amidst a virtual standstill in Asia’s transport and aviation industries could further cap growth in Singapore’s transport-related export products such as aircraft parts, ships and boats, and piston engines as evident in September’s non-electronic NORX.

Overall, the level of uncertainty surrounding the COVID-19 pandemic amidst heightened geopolitical-led concerns remains significant, and will continue to cloud Singapore’s trade prospects.

Singapore’s export momentum has also stayed soft as seen from the seven straight months of contraction in overall exports. Still, given the continued expansion in NODX year-to-date, we keep to our view for NODX to grow by 4% in 2020 with upside risks. This is compared to Enterprise Singapore’s revised NODX outlook of between 3% and 5% (up from a previous forecast range of between - 1% and -4%).

Advertise

Advertise