Learn how this talent investor is forming the world's best startup founders

Doralyn Chan reveals Entrepreneur First’s plans to create more than 300 companies over the next three years.

Entrepreneur First (EF) started as a nonprofit to help individuals find funding and support for their ideas. Spotting the ever-changing startup trends in Asia, the company partnered with SGInnovate to open a regional headquarters in Singapore, with aims to build globally important startups from scratch in London, Singapore, Berlin, Hong Kong, Paris and Bangalore.

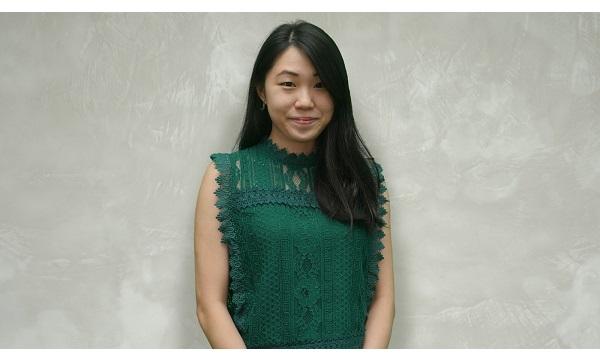

EF’s funding manager, Doralyn Chan, who was once a practising lawyer in one of the leading local law firms, said that the company was built on an unusual premise: that the world is missing out on some of its best founders. She describes the company as a “talent investor” who can help equip the world’s most ambitious and impactful people to lead these startups.

With so many talented individuals looking to change the world or do the impossible, EF assists founders in navigating the fundraising process and developing effective strategies to materialise their companies.

EF has been ramping up its efforts in funding companies in the early stages. Chan noted that in 2018, the lion city’s startup industry reached the point where a quarter of the seed capital was invested in an EF company.

In an interview with Singapore Business Review, Chan talks about EF’s key milestones and the recent opening of the Toronto office, as well as her upcoming session at SBR's Hottest Startups Panel Briefing 2019.

Can you describe to us your previous work or personal experience? How did it contribute to who you are as an entrepreneur today?

I advise and support world-class tech founders at EF, the leading global talent investor. I am responsible for the Singapore, Bangalore and Hong Kong portfolio companies, and have helped over 50 technical founders navigate the fundraising process and develop effective funding strategies.

Prior to EF, I was a lawyer in one of the leading local law firms in Singapore, specifically in a firm that was featured in the Global Restructuring Review 30 List as the world’s top Asian headquartered restructuring and insolvency practice. I read law at the London School of Economics and Peking University, and worked on complex cross-border debt restructuring as well as advising and representing corporates in banking and financial disputes.

What are your key business philosophies?

As a whole, venture capital addresses the capital gap by funding existing startups that have potential. However, I’ve come to realise that to create meaningful companies with impact, we have to first take one step back – because the world is missing out on some of its best founders. To find these people, you need a completely new model. At EF, we call this talent investing. We invest time and money in the most talented and ambitious individuals, even before they have an idea or co-founder, and equip them with the tools to start a company.

Tell us something about EF. What would be the company’s significant milestones?

EF first started in 2011 as a nonprofit organisation. Eight years later, we have now helped over 1,200 individuals build more than 200 companies, with a valuation of more than $1.5 billion. One of our most significant milestones would be our overseas expansions. Our first location out of the UK was Singapore, which we launched in 2016 with the support of SGInnovate. Today, Singapore is our Asia headquarters, and we’re at a point where more than a quarter of Singapore’s seed capital last year was invested in an EF company. We’ve continued to expand and have now established a presence in six locations, including Singapore, Hong Kong, London, Berlin, and Paris. In fact, we have also recently unveiled our newest office in Toronto!

Additionally, we were excited to have announced our global fund earlier this year. The $115m first close is one of the largest pre-seed funds ever raised, and will enable us to invest in more than 2,000 individuals and create more than 300 companies over the next three years. We are fortunate to have LPs such as Reid Hoffman, Founders Fund and Greylock Fund, among others, who back and believe in our mission.

Can you give us a glimpse of what you will talk about at the 20 Hottest Startups Panel Briefing 2019?

I’m looking forward to diving into the investment trends we’ve observed that are unique to this region. We’re seeing an increased interest in early stage investment in SEA, and many family offices and corporates are joining the likes of angel investors and VCs to invest at the early stage. It would be interesting to have a discussion with my fellow panelists around these differences in mandates and investment styles and share more about the various approaches to raising capital from these investors.

Singapore Business Review’s Hottest Startups Panel Briefing 2019 is happening on 24 October at Four Points by Sheraton Singapore. To learn more about the event, click here. To register, click here. For inquiries, you may contact Kim at [email protected] or +65 3158 1386 ext 224

Advertise

Advertise