New life insurance business premiums up 10% in Q1

More consumers take action to secure their financial future in view of COVID-19.

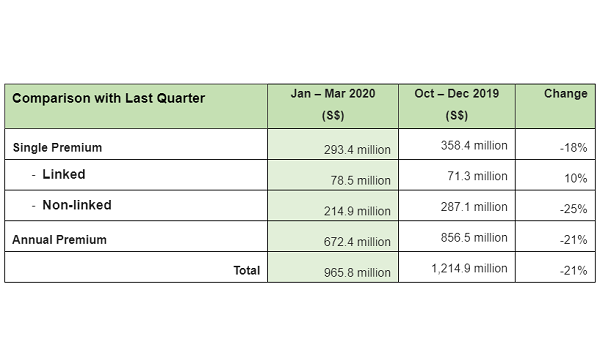

Singapore’s life insurance industry recorded a total of $965.8m in weighted new business premiums in Q1, which is a 10% YoY rise from the same period in 2019, according to data from the Life Insurance Association (LIA).

The single premium business jumped 31% QoQ in weighted single premiums to $293.4m in the same quarter, attributed to insurers’ new product launches and associated promotional activities. Par and non-par products comprised 73%, whilst single premium linked products made up the remaining 27%.

In addition, CPFIS-included products comprised 16% and cash-funded products took the remaining 84%.

Annual premium policies also inched up 3% YoY, amounting to $672.4m in total weighted annual premiums.

In tandem with the growth in single and annual premium policies, the total sum assured for new business rose 20% QoQ to $34.6b in Q1.

“The industry continues to make headway in bridging protection gaps in the first quarter as more consumers take action to secure their financial future in view of COVID-19’s drastic impact on global and local markets. However, with circuit breaker measures, climbing unemployment and an impending recession, the life insurance industry may see the knock-on effect in the coming quarters,” said Khor Hock Seng, president at LIA Singapore.

As for the industry’s employment scene, LIA added that it rose 4% YoY with 359 net new hires. This brings Singapore’s life insurance industry’s workforce to 8,668 employees as at 31 March. The report also furthered that 14,604 representatives held exclusive contracts with companies that operate a tied agency force within the same period.

As at end-March, 57,000 more Singaporeans and permanent residents were covered by Insurance Shield Plans (IPs) and riders, bringing to a total of approximately 69% of Singapore residents being protected by IPs and riders.

Total new business premiums for individual health insurance in Q1 amounted to $101.8m. Overall, IPs and IP rider premiums accounted for 87% ($88.2m), whilst the remaining 13% ($13.6m) comprised other medical plans and riders.

However, there was a 4% YoY dip in the uptake of retirement policies in Q1 with 11,713 retirement policies purchased. Retirement policies totalled $107m in weighted premiums in the same quarter, accounting for about 11% of total weighted premiums.

Advertise

Advertise