/Momentum.asia

/Momentum.asia

Chart of the Day: Grab food delivery outperformed ASEAN peers in GMW growth

It sustained growth consecutively in the past three years.

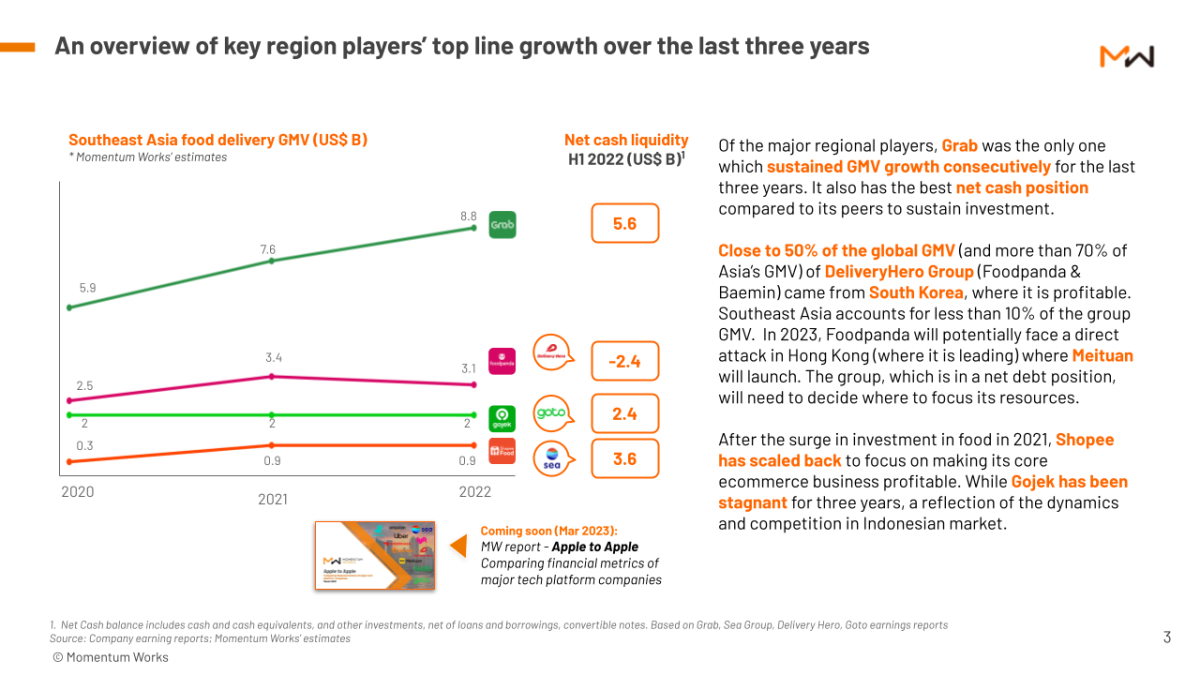

Amongst its Southeast Asian food delivery peers, Grab was the only major player that sustained gross merchandise value (GMV) growth consecutively in the past three years.

This chart from Momentum Asia’s 2023 study also showed that the Singapore-owned firm (GMV = $11.5b, US$8.8b) has the best net cash position compared to its competitors, Foodpanda (GMV = $4.08b, US$3.1b), Gojek (GMV = $2.6b, US$2b), and Shopeefood (GMV = $1.1b, US$900m).

Grab posted $7.3b (US$5.6b) net cash liquidity in the first half of 2022, Foodpanda, whose parent company is delivery hero, was down $3.1b (US$2.4b), Gojek (parent company: Goto), posted $3.1b (US$2.4b), SEA Limited’s Shopeefood posted $4.744 (US$3.6b) in net cash liquidity.

Southeast Asia’s food delivery sector was unfazed in 2022 with the help of physical store reopenings and demand in profitable investments went up. The sector’s yearly GMV growth in 2022 was at 5% to $21.4b (US$16.3b).

$1 = US$0.76

Advertise

Advertise