Golden Gate Ventures' US$100m early-stage fund oversubscribed

The fund focuses on consumer internet trends in Southeast Asia.

Golden Gate Ventures’ third fund, a US$100m early-stage venture capital (VC) fund for consumer internet trends in Southeast Asia, is oversubscribed and closed to new investors.

Golden Gate Ventures Fund III is anchored by existing investors which include Temasek, Hanwha, Naver, and EE Capital. New investors include Taizo Son’s Mistletoe, Mitsui Fudosan, IDO Investments, CTBC Group, Korea Venture Investment Corporation (KVIC), and Ion Pacific.

According to the fund, the announcement comes on the heels of three trends coalescing in Southeast Asia.

“First is the rise of consumer spending and mobile internet adoption,” it said. “The second is the flood of foreign capital looking to invest in the region. Some recent examples are Sequoia’s latest fund of $695m for India and Southeast Asia, and Chinese tech titans Alibaba and Tencent pouring billions into unicorns such as Lazada, Tokopedia, Go-Jek, and Traveloka.”

The third is the rise of serial entrepreneurs and skilled tech engineers in the region. “As the ecosystem nears seven years old, ex-founders and ex-CTOs are breaking out of unicorn companies to start new businesses as the second generation of entrepreneurs,” it added.

Golden Gate Ventures’ proprietary deal tracking database projects at least 400 VC investments across the region in 2018. The VC firm uses CRM software to track more than 1,000 deals a year across over 450 funds, along with proprietary in-house databases for investment tracking, follow-on financing, and relationship management of over 21,000 contacts.

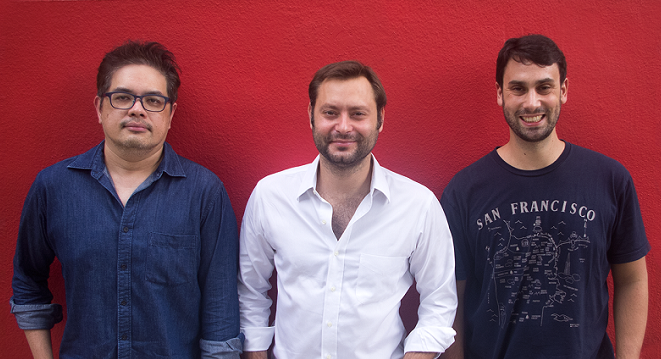

“When I compare the tech ecosystem of Southeast Asia (SEA) to other markets, it’s really hit an inflection point—annual investment is now measured in the billions. That puts SEA on a global stage with the US, China, and India. Yet there is a youthfulness that reminds me of Silicon Valley circa 2005, shortly before social media and the iPhone took off,” Vinnie Lauria, Golden Gate Ventures co-founder commented.

To date, Golden Gate Ventures’ first two funds have had distributions of cash (DPI) of 1.56x and 0.13x, resulting in IRRs of 48% and 29%, respectively.

Advertise

Advertise