Singapore clinched $145.78m of healthtech deals in 2018

The city trails only behind China and India in terms of deal value.

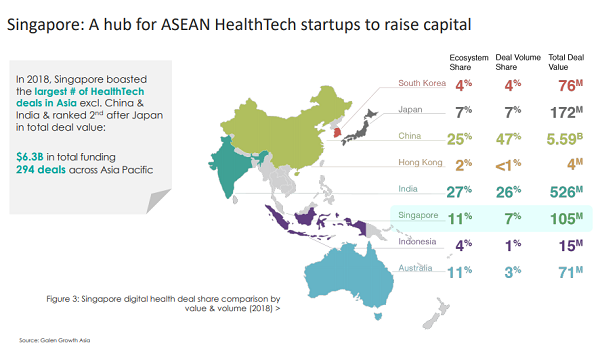

Singapore raked in $145.78m (US$105m) of healthtech deals in 2018, making it the city with the fourth largest deal volume in Asia, according to a report from Galen Growth Asia. The city accounted for about 7% of 294 deals across Asia-Pacific, tied with Japan at third place.

Singapore's healthtech startup ecosystem grew to 174 in 2018 from 45 in 2012 and 106 in 2015. The market has a compound annual growth rate of 23% from 2015 to 2018.

China and India raised the highest total deal value in 2018 at $7.76b (US$5.59b) and $730.65m (US$526m) respectively. China held the largest deal volume share at almost half or 47%, followed by India at 26%. Healthtech deals in Japan hit $238.77 (US$172m) over the same period, rounding out the top three.

Also read: Asian healthtech deals surged 56.8% to US$4.97b in Q3

The percentage of Singapore startups in Pre-A and Series A stages grew to 6% and 10%, respectively, from 4% each in 2015.

Top focus areas were wellness (19%), medical diagnostics (14%), and health management solutions (13%).

There have been 58 unique investors in the past 12 months, led by SG Innovate with four investments. This is followed by Heritas Venture Fund, Venturecraft and Wavemaker Partners with two investments each over the same period.

About 40% of investors came from Singapore, whilst foreign investors came from the USA (25%) and India (20%).

Amongst the top 20 Singapore-based healthtechs, a fifth operate only in Singapore, with 40% within Asia. The remaining 40% operate globally.

Additionally, out of the $19b public investments in research & innovation, $4b alloted to the health and biomedical sciences sector for 2015-2020.

Advertise

Advertise