Markets & Investing

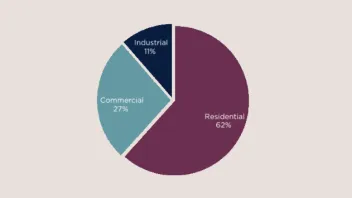

Chart of the Day: Residential properties take lion's share of investments in Q422

Chart of the Day: Residential properties take lion's share of investments in Q422

Residential investment sales volume clocked in at $1.26b.

Yangzijiang Financial dives into Asia private credit assets

The company partnered with Tahan Capital Management for its new business.

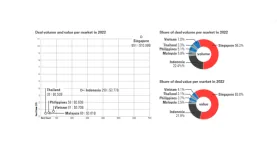

COTD: SG takes lion's share of equity funding in SEA

In 2022, Singapore’s deal value hit $10.99b.

Can Singapore’s private capital market sail through rough global waters?

In 2022, venture capital funding in the city-state fell further to US$10.99b.

Gov't revamps GIP to benefit local start-ups

The changes will support Singapore’s start-up and financial ecosystem.

‘Stand-off’ between VCs and entrepreneurs pushes funding volumes down

In the fourth quarter of 2022, VC investment dropped to $22.6b.

Oil and gas and utilities only sectors that closed positive in stock market

Amongst top performers are Keppel Corporation and Genting Singapore.

Jardine C&C’s net profit rises 12% YoY to US$740m in FY22

Given the increase, the board proposed a 39% YoY higher dividend per share.

UOL net profit surges 60% YoY to $491.9m in 2022

Its revenue also increased by 28% to $3.2b.

Olam Group PATMI down 8.3% YoY to $629.1m in 2022

Its PATMI for H2 FY2022 declines by 24.5% YoY to $200m.

Daily Markets Briefing: STI climbs by 0.53%; Keppel is most active stock

Keppel was the top stock with a 2.41% increase.

Broker: Sembcorp Industries has ‘buy’ rating over manageable debt levels

Sembcorp Industries will also see a growth of mergers and acquisitions activity in 2023.

Daily Markets Briefing: STI declines 1.06%; SATS is most active stock

SATS was the top stock with a 2.94% increase.

CapitaLand Investment launches opportunistic partners programme in China

A total of $1.1b equity has been committed to the programme.

2Y SGS bond ‘attractive enough’ to draw demand: UOB

The June 25 bond was first issued in 2015 but was retapped.

Diversifying your portfolio: Alternative investments in Singapore to consider in a low-interest rate environment

In today's uncertain financial landscape, investors need to diversify their portfolios to manage risk and maximise returns. With the current low...

6 in 10 Singaporean retail investors plan to trade more in 2023

They plan to use the "buy the dip" strategy this year.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform