Condo, HDB rents steadily improve in November

The middle, upper rental market may benefit from expected influx of hiring from certain sectors.

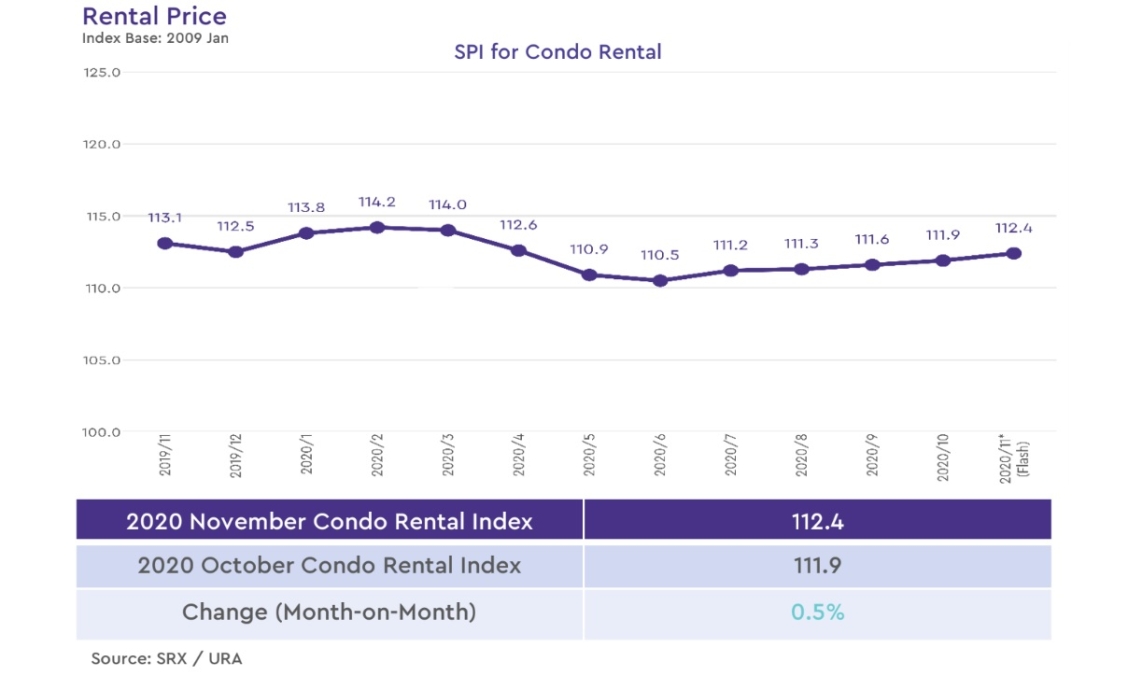

Both condo rental prices and HDB rental prices steadily climbed for the fifth straight month in November, although prices are still below than those recorded in 2019, according to the latest report by SRX.

Condo rents fell 0.6% YoY in November compared to last year, but rose 0.5% MoM from October’s rent prices. Rents in the Core Central Region (CCR) and Rest of Central Region (RCR) dropped by 3.5% YoY and 0.6% YoY, respectively, whilst Outside of Central Region (OCR) rents climbed 1.2% YoY.

Compared to October, RCR and OCR rents edged up 1.6% MoM and 0.2% MoM, respectively, whilst OCR rents reversed by 0.4% MoM.

A total of 4,443 condo units were rented in November, 1.1% YoY higher than in November 2019 or 3.8% MoM higher than the 4,281 units rented in October 2020. This is 11.2% higher than the five-year average volume for the month of November.

By regions, 39.4% of the total volumes are from OCR, 32.8% from RCR, and 27.8% from CCR.

Meanwhile, the HDB rents also fell 0.8% YoY in November. Compared to October, prices remained unchanged, as the 0.4% MoM decrease in mature estates rents were offset by the 0.6% MoM increase in non-mature estates rents.

Overall, HDB rents are down 13.7% from the peak in August 2013.

By room type, three-room rents decrease by 0.3% MoM compared to prices in October, whilst four-room, five-room and executive rents increase by 0.1% MoM, 0.4% MoM and 0.8% MoM, respectively.

Compared to November 2019, rents for three-room and executive declined by 0.1% YoY and 2.1% YoY, respectively, whilst four-room and five-room rents increased by 2% YoY and 0.1% YoY, respectively.

An estimated 1,762 flats were rented in November 2020, an increase of 6.7% from the 1,652 units in October 2020. However, this is 11.7% YoY lower than volumes recorded in November 2019.

Volumes are also 8.7% lower than the five-year average volume for the month of November.

Breaking down by room types, 34.3% of the total volumes are from three-room, 34.2% from four-room, 26.2% from five-room, and 5.3% from executive.

Continued recovery may come especially to the middle and upper tier rental market, as certain sectors may be looking to ramp up their employment, such as the digital finance sector, according to Christine Sun, head of research and consultancy at OrangeTee & Tie.

“After the Monetary Authority of Singapore awarded four new digital full bank licenses, we may see more foreign professionals withniche skills being employed next year, including specialised fraud and credit risk management personnel, data privacy specialists and other information technology hires,” Sun noted. “These highly skilled workers who will probably command higher incomes or housing budgets will likely benefit the middle to upper tier of the rental market such as private homes in the luxury and city fringe areas.”

Sun estimates that overall rental volume may decline by 5% to 8% in 2021.

“Rising home completions and the macroeconomic uncertainties may exert some downward pressure on rental prices. Therefore, rents may fall up to 4% next year,” she added.

Advertise

Advertise