HDB resale prices up for the fifth straight month in November

The number of million-dollar HDB resale deals for 11M 2020 smashed 2018’s record.

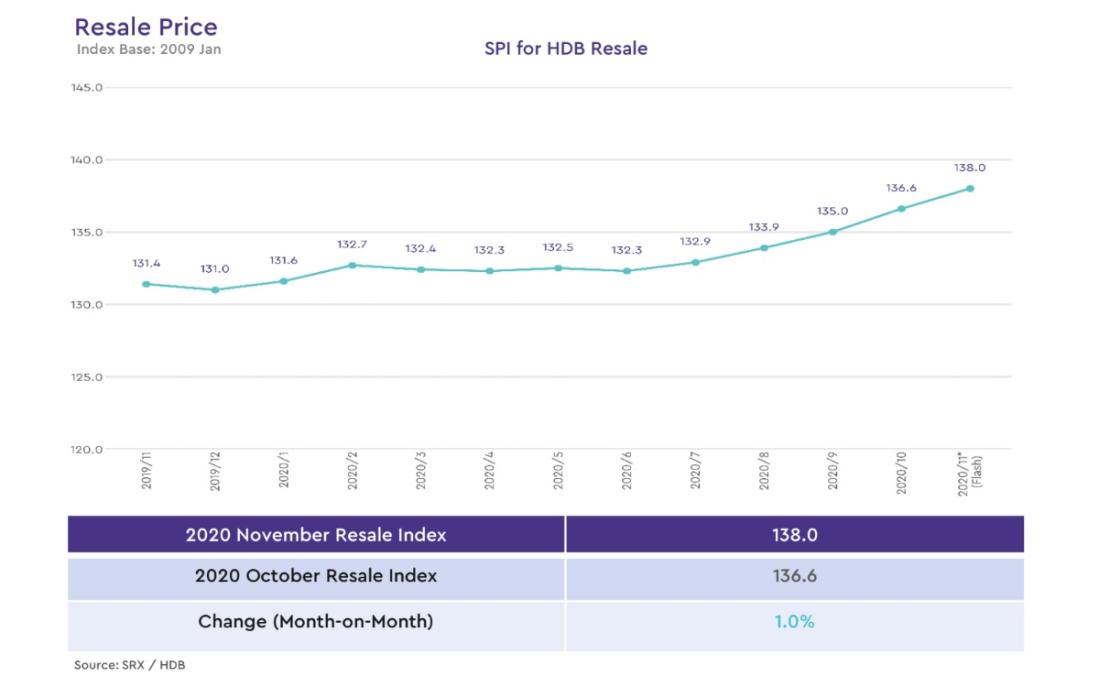

HDB resale prices climbed for the fifth consecutive month in November as the number of resale units sold over the price of $1m hits a record high.

Data from the latest market flash report by SRX revealed that resale prices jumped 5% YoY in November compared to the same month in 2019, driven by increases in the prices of all room types.

The prices of three-room and four-room units edged up by 4.6% YoY and 4.2% YoY, respectively. Five-room and executive unit resale prices also rose by 4.5% YoY and 2.5% YoY, respectively during the month.

A total of 2,331 HDB resale transactions were recorded in November—21.7% YoY higher than that of November 2019.

Of these, a total of 13 HDB resale flats were resold for more $1m or more, a new record high.

This also brings the number of million-dollar HDB resale transactions to 72 in the first 11 months of 2020 – smashing the previous record of 71 such deals in 2018. In comparison, last year, there were 64 million-dollar HDB resale transactions.

Buyers have likely placed substantial value on million-dollar flats’ attributes such as its central location, convenience of being near to the city, amenities, as well as sweeping views of downtown Singapore from units on higher floors, said Siew Ying Wong, head of research and content at PropNex, further noting that private condo prices have remained quite resilient through the pandemic.

Budget and housing needs may also have come into play. “A family-sized private condo in the suburbs could cost $1.5m, but for a $1m or so, the buyer can get a relatively similar size HDB resale unit on a high floor and in a prime spot near the city. A large portion of these million-dollar HDB flats are fairly new as well, with remaining lease of 89 years or longer. All these factors help to increase the appeal of such million-dollar resale flats, which still account for only a tiny fraction of total HDB resale transactions,” Wong said.

The highest transacted price for a resale flat in the month is for a five-room unit at The Pinnacle@Duxton, resold for $1.248m. Amongst non-mature estates, the highest transacted price is achieved at $810,000 by a five-room DBSS unit at Parkland Residences.

Compared to October, HDB resale prices increased by 1% MoM. Resale prices of all room types rose compared to a month earlier, with three-room, four-room, five-room and executive prices rising by 1.3% MoM, 0.6% MoM, 1% MoMand 1.3% MoM, respectively.

The volume of resale transactions in November were also 4.3% lower than those in October.

By room type, 41.9% of the volume comes from HDB four-room, 26.6% from five-room, 22.1% from three-room, and 8.2% from executive. The rest are from one-room, two-room, and multi-gen.

Mature and non-mature estate prices expanded by 3.4% and 6% compared to November 2019.

Advertise

Advertise