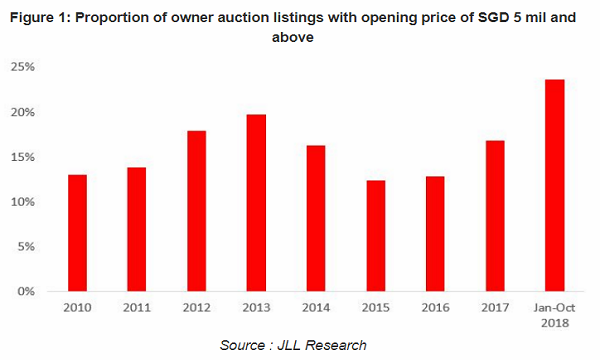

One in four properties for auction in January to October is a posh asset

The ultra-rich view auction as an effective mode of asset disposal.

Auction is gaining traction amongst high net worth individuals as an effective mode of asset disposal with one in every four properties in the first ten months of 2018 were worth $5m and above, according to real estate services firm JLL.

The headline figure climbed significantly from 2010 where at least one in 10 owner listings were put up for auction.

Also read: 291 auction listings in Q3 highest since Q1 2011

The report drew upon the sale of good class bungalows (GCBs) at Chestnut Drive for $11.4m in 2017 as an example of a notable high-value owner auction. Another property at Chee Hoon Avenue was sold for $22.9m in 2013, whilst a development within the White House Park area sold for $13.6m in 2010.

“These were sealed at 13-26% above their respective opening bids,” Terry Poon of JLL Singapore noted.

Meanwhile, even developers and landowners are citing auction as an effective mode of sale. In 2006, Sentosa Development Corporation sold 12 oceanfront bungalow land parcels on the resort island of Sentosa Cove through an international auction at $5.56-$8.15m each. “Frenzied biddings amidst keen competition for the coveted land parcels resulted in benchmark land prices set,” he added.

In addition, the developers of prime condominium development Suites @ Newton placed two units for auction in 2015, whilst two seafront bungalows at Wak Hassan Drive with opening bid prices of above $5m each were also put up for auction in 2017.

Also read: Luxury property sales crashed 42% in Q3

“As seen in Singapore, there is a growing trend of owners of high-end properties turning towards auction as a form of sale,” Poon highlighted. “It is hoped that as the negative light of auction properties begin to dim, more buyers will turn to it as a possible mean of acquiring assets in Singapore.”

The misconception of auction properties in Singapore being inauspicious, on significant discounts or foreclosures are wildly inaccurate, as on average, mortgagee listings comprised just 30% or less of all auction listings between 2012 and 2018, Poon highlighted.

“In contrast, listings by owners (non-foreclosure properties) contributed the bulk, or above 70% of all auction listings annually between the same time period, reaching a high of 90% in 2013,” Poon said.

Advertise

Advertise