Private home sales plunged 38.6% in Q4 2019

Developers held back launches during the festival season.

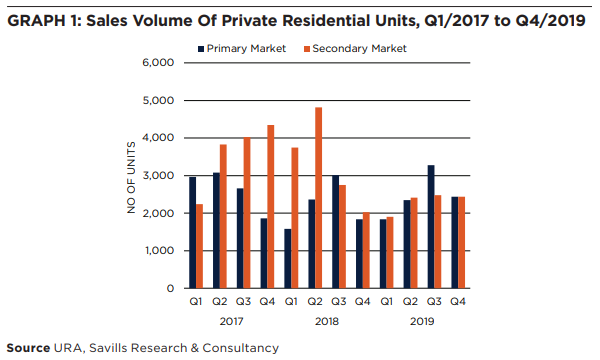

Private home sales in Q4 2019 fell by 38.6% QoQ to 2,226 new uncompleted units as developers held back launches amidst the year-end holiday season, according to data from Savills Singapore.

Developers rolled out 1,129 units from 11 new projects, which are mostly located in the Core Central Region (CCR) and Outside Central Region (OCR). Amongst these, about 60% are accounted for by Sengkang Grand Residences at Sengkang Central (280 units), Urban Treasures at Jalan Eunos (237 units) and One Holland Village Residences at Holland Village (156 units).

With less new supply, primary sales in Q4/2019 correspondingly fell by 25.5% QoQ from the previous quarter to 2,443 units. By market segment, new sales in the OCR accounted for 46.5% of the total, followed by the Rest of Central Region (RCR) and CCR at 37.0% and 16.5%, respectively. The top five best-selling projects in Q4 were Parc Esta, Sengkang Grand Residences, Treasure At Tampines, One Holland Village Residences, and Jadescape.

Sengkang Grand Residences, a 680-unit residential project in an integrated development at Sengkang Central, was launched at the beginning of November 2019. Based on the caveats captured in Realis, a total of 232 units were sold at an average price of $1,746 psf by year-end.

The 296-unit One Holland Village Residences, which is also a part of a mixed-use development known as One Holland Village, has sold 112 apartments with an average price of $2,679 psf since its preview sales on 21 November 2019.

The other three top-selling projects mentioned above have been previously launched projects. “These projects’ convenient locations and attractive per sq ft prices compared with newer launches continue to be the key drivers moving sales. In addition, some developers continued offering attractive commissions to agents to promote the unsold inventory in their projects, which also played a part in encouraging sales,” said Savills Singapore CEO Marcus Loo.

New sales volumes in 2019 finished at their second strongest pace since 2014, rising 12.7% over 2018 to 9,912 units. However, the ability to maintain the sales momentum in 2020 remains a concern, Loo noted.

According to a Savills study of private condo projects which were launched in 2019, the take-up rates in the first month has been low. Among these 52 projects, 31 or close to 60.0% of the projects have a take-up rate less than 10.0%. This is followed by nine projects or 17.3% of the total that saw take-up rates ranging from 10.0% to 20.0%.

“Besides external factors, such as economic uncertainty and weak job market, new projects’ benchmark prices and hefty stamp duty paid for the second property and above continued to be the main drags in the sales market. In addition, buyers may have adopted a wait-and-see approach in view of ample launches in the future,” Loo added.

Resales and sub-sales remained stable on the other hand, with a total of 2,435 units sold in the secondary market in the last quarter of 2019. This was just 1.9% lower than the number registered a quarter ago. In view of the impact of the year-end holiday season, the sales volume was quite healthy, especially in the CCR, which posted a 6.2% QoQ increase to 569 units.

Nevertheless, 2019 was a weak year for the secondary sales market. It posted a steep 30.8% YoY decline to 9,238 units sold for the whole year. Loo commented, “Active new launches may have diverted some buyers’ interests in the secondary sales market.”

Permanent residents (PRs) and foreigners bought a total of 970 condominiums and private apartments in the same quarter. Although the transaction volume fell by 7.9% QoQ, their combined market share has increased by 2.1ppts QoQ to 22.4%.

The top-selling projects amongst PRs were Parc Esta (37 units), Parc Clematis (29 units) and Jadescape (20 units), while foreigners bought considerable number of units at Marina One Residences (17 units), Martin Modern (16 units) and The Crest (11 units).

By nationality, top non-Singaporean buyers in the final quarter are still from China, Malaysia, India and Indonesia, who acquired a total of 492 units. In addition, foreigners who did not specify their nationality also bought 288 units which were all sold in the primary market.

Prices for landed properties island-wide recorded the highest quarterly growth rate of 3.6%. This was followed by the 2.8% QoQ rise achieved by non-landed private residential properties in the OCR. On the other hand, for non-landed private residential properties in the CCR and the RCR, prices fell by 2.8% QoQ and 1.3% QoQ respectively.

The price drop in these two market segments could be due to two reasons. One is that some new projects were launched with relatively attractive prices in Q4 compared with those launched in the previous quarters mainly because of their location attribute. The second is that given the hedonic construct of the URA index, there could be attributes for the units transacted in those regions that the model could not adequately explain, for example, layout of unit, orientation of unit, Loo said.

Despite the holiday season, transaction volumes and prices in the high-end market remained stable. Figures compiled by Savills showed that the prices for high-end, non-landed residential projects edged up 0.3% both QoQ and YoY in the last quarter and by end-2019, averaged at $2,410 psf.

Advertise

Advertise