Singapore housing market ‘remarkably stable': UBS

It is the most improved housing market in terms of affordability.

Singapore’s housing market remains in the fair-valued zone after government regulations reined in the growth of property prices, according to the latest UBS Global Real Estate Bubble Index.

“The brief housing boom between mid-2017 and mid-2018 is over. Prices have stagnated since and the number of transactions fell,” the report read.

The Lion City scored 0.45 to rank 20th out of the 24 cities studied and was noted for being the most improved housing market in terms of affordability. Housing affordability deteriorated the most in Hong Kong, although it fell to the third spot amongst cities with the greatest housing bubble risk globally.

UBS attributed Singapore’s market slowdown primarily to three factors: government regulation, declining population, and an expected economic downturn in the near-term.

“The government is keeping the market on a leash. The additional buyer stamp duties (ABSD) for developers and purchasers of investment properties introduced last year have put a lid on the price upside and curbed speculative demand. Population growth has also declined notably in the past two years. Finally, economic momentum is expected to deteriorate, limiting the willingness to pay,” the report read.

Also read: Unsold inventory may support property sales amidst weakening take rates

In addition, UBS said that the risk of a price correction was limited due to sound market fundamentals such as a decreasing vacancy rate, good affordability, and a healthy employment rate.

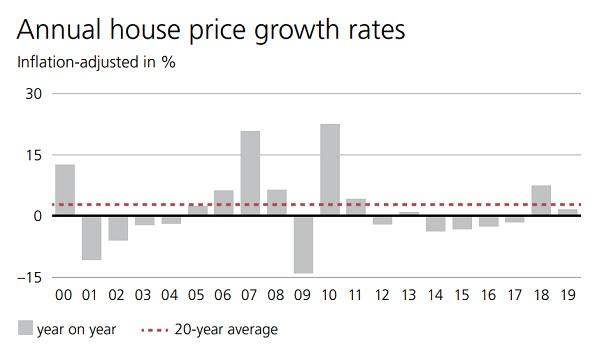

“The Singapore housing market is one of the few amongst those we cover in which private housing affordability has improved in the last 10 years. Current prices are similar to those in 2008 whilst household incomes have climbed by 20%,” said UBS.

“Nonetheless, affordability is still stretched. It takes 12 annual incomes to buy a 60 sqm (650 sqft) apartment on the private market,” the report said, adding that it expects prices to hold steady over the coming quarters .

Munich, German and Toronto, Canada occupied the first and second spots respectively. Housing prices in Munich doubled over the past ten years, whilst Toronto’s housing market is plagued with prices that tripled in 17 years. German city Frankfurt closed the top five as prices soared 11% in 2018—the highest rate amongst the cities studied by the UBS.

Advertise

Advertise