Higher spending fails to boost retail rents from protracted slump

E-payments may not be fully taken into account in the sector’s quarterly performance.

Even as locals stepped up their festive purchases ahead of discounts offered before Hari Raya Aidilfitri and businesses jumpstarted their expansion plans, Singapore’s retail rents remained in negative territory after slipping 1.1% in Q2 and reversing the slight 0.1% growth booked from the previous quarter, according to real estate consultant Savills.

“This underscores a market that remains mired with challenges, including technological disruption and rising operational costs,” Tay Huey Ying, head of research, JLL Singapore said in a statement.

Also read: Retail space prices down 1.2% in Q2

Despite the bleak outlook, island-wide vacancy rates have actually plunged to its lowest point in two years at 7.3% in Q2 as companies stepped up expansion plans including ZARA who took over the space vacated by Forever21 with the goal of occupying 29,000 sqft at level one and co-working operator JustCo also launched its sixth and largest facility which spans 60,000 sq ft at Marina Square.

Foreign brands also continued to remain optimistic in the local retail retail market with French fashion label 6ixty8ight opening its first store in Southeast Asia at Vivo City whilst Israel-based bath and body brand Sabon opened its first regional flagship boutique at Ngee Ann City.

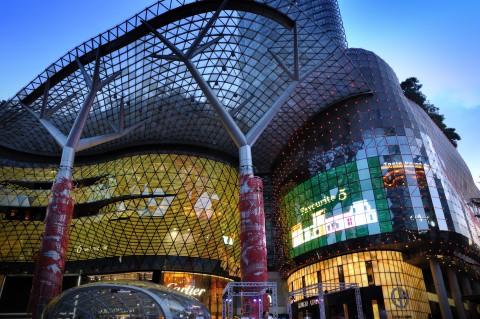

Italian fashion label Maryling opened its first boutique in Singapore, spanning over 1,270 sqft at The Shoppes at Marina Bay Sands whilst UK sports fashionr etailer JD sports unveiled a 7,200 sqft flagship store at ION Orchard following its first retail offering at Jurong Point Shopping Centre.

However, the series of expansions may not be enough to push leasing costs back into the black. “Even though these moves lent some support to occupancy levels, overall retail rents have been restrained by low rental rates for anchor tenants,” observed Savills.

Also read: Is the worst over for embattled Singapore retail REITs?

Prime monthly rents in Orchard Road and suburban areas remained flat at $29.90 and $28.80 psf respective in Q2.

The subdued rental environment that can be traced back to Q3 2015 therefore raise concerns regarding the sector’s full-fledged recovery as it continues to remain unmoved despite the positive growth that have already boosted other metrics.

“Accordingly, the stress on retail rents is expected to continue because of the preference of landlords to maintain occupancy rates rather than increase rents,” Moody's Investors Service said in an earlier report.

However, Savills argues that conventional retail metrics may also be at fault for failing to take into account the surge in digital wallet usage which are steadily accounting for a greater share of retail payments as an important parameter of the sector's performance.

Also read: PayNow Corporate goes live

“The advent of the electronic wallet could already be fuelling greater retail expenditure but may not be captured by traditional retail performance measures,” Alan Cheong of Savills Research said in a statement.

A consumer survey from Visa revealed that 87% of Singapore consumers embrace e-payments over cash, lending support to the argument that electronic wallets are overtaking traditional cash and credit card payment means in payment.

Also read: Singaporeans embrace e-marketplaces amidst explosive mobile usage

Businesses are also responding to the cashless shift with 2 in 3 SMEs admitting that they are likely to do away with cash and cheque for their customer dealings and go entirely cashless by 2023, according to a survey from OCBC.

“The reason why we mention this point is that it is now starting to look very counterintuitive that, on the one hand, we’ve seen retail sales figures stuck in neutral gear for a few years whilst during that same period, both household income and tourist expenditures have risen significantly,” the real estate consultant observed.

Advertise

Advertise