Property investment sales jumped 34% to $6.3b in Q1

State tenders surged to $3.1b from $110m in Q4 2018.

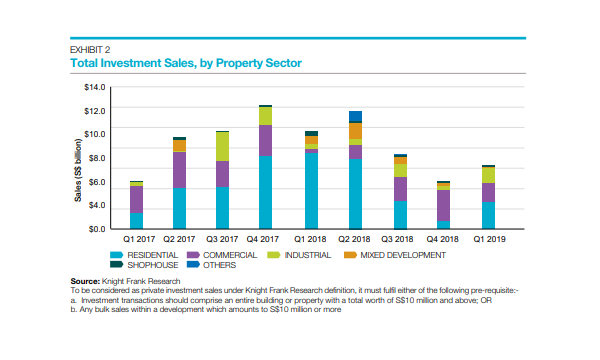

Despite the slowdown in en bloc market, total investment sales went up by nearly 34% to $6.3b in Q1 2019 from $4.7b in Q4 2018, according to a report by Knight Frank.

The increase in sales was partly attributed to the closing of state tenders in Q1, with public sales surging to $3.1b from $110m in Q4 2018. Although the outlook for private residential market was more subdued after the announcement of the eighth round of cooling measures in July 2018, developers were still actively seeking sites that have great connectivity and potential for future growth.

The report pointed out how the Government Land Sale (GLS) site at Middle Road drew 10 bids from developers, whilst the sale of the Pasir Ris white site to the joint venture between Allgreen Properties and Kerry Properties was said to be the largest deal sold through state tender at $700m or $684.50 psf ppr.

On the other hand, commercial property sales came down from $3b in Q4 2018 to $1.9b in Q1 2019. Notable deals in 2018 included the sale of the GLS hotel site along Club Street for $562.2m, Liang Court for $400m, and Rivervale Mall for $230m.

Meanwhile, the interest in hotels and serviced apartments was keen because of the more optimistic outlook of the hospitality sector, according to Lee Nai Jia, senior director and head of research at Knight Frank, and Lucy Zhu, research analyst for Knight Frank. “A case in point was the state tender for the hotel site along Club Street that attracted eight bids,” they highlighted.

And whilst there was no major office building sales in Q1 2019, the strata office market remained active. ARA Asset Management reportedly sold six levels at Suntec City for $160m, whilst Oversea-Chinese Banking Corporation (OCBC) sold three levels of The Octagon along Cecil Street for $45.5m.

“The strong performance of office rental market also contributed to the growing interest in commercial properties. For example, Oxley Holdings reportedly received a $1.03b offer for Chevron House after owning for a year when they acquired the building for $660m,” Lee and Zhu added.

Additionally, Knight Frank observed that investors continued to seek opportunities in overseas market in Q1 2019, albeit at a slower pace. Outbound investment from Singapore dropped to about $12.4b in Q1 2019 from $20.7b Q4 2018.

Notable overseas investments included ARA Asset Management’s acquisition of Seoul Square in South Korea, CapitaLand’s acquisition of 70% of Pufa Tower in Shanghai, China in a 50:50 joint venture, and Keppel Corporation purchase of Shanghai Yi Fang Tower Complex at Shanghai’s Hongkou District.

“With the United States Federal Reserve announcing that they are unlikely to increase interest rates in 2019, we expect the rental and capital return of Singapore real estate to outperform the 10-year Singapore government Bond rates,” Lee and Zhu highlighted, adding that demand for Singapore real estate assets is likely to increase as a result.

According to Knight Frank, the 10-year Singapore government bond yields fluctuated between 2.0% to 2.5% between Q1 2018 and Q1 2019, and there were signs that the bond yields would be under pressure to decline.

The draft Master Plan 2019 and the rolling out of the CBD Incentive Scheme and Strategic Development incentive schemes are also expected to offer opportunities for investors and landlords that own aging office or retail buildings to redevelop.

The new incentives and draft master plan are likely to trigger investment sales in the commercial market.

“We anticipate the cross-border investments from Singapore continue to grow, especially for gateway cities and cities that show upside growth potential,” Lee and Zhu concluded.

Advertise

Advertise