Top 5 S-REITs averaged total return of 8.5% in 2020 YTD

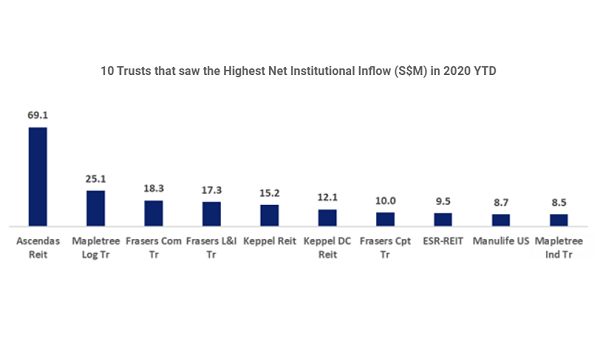

Ascendas REIT leads the pack with a net institutional inflow of $69.1m.

The five best-performing S-REITs posted an average total return of 8.5% in 2020 YTD, which outpaces the benchmark total returns, according to an SGX report.

Ranked based on their net institutional inflow, Ascendas REIT led its peers at a $69.1m. This is followed by MapleTree Logistics Trust at $25.1m, Frasers Commercial Trust $18.3m, Frasers Logistics & Industrial Trust at $17.3m and Keppel REIT at $15.2m.

Overall, REITs continued to maintain turnover growth in the 2020 YTD, with 43 property trusts generating 26% of the stock market’s $1.23b average daily turnover. This compared to the REIT sector contributing 24% to Singapore’s overall stock market turnover in 2019.

Based on their respective 2019 turnovers, trusts with the highest turnover growth, included Prime US REIT, Dasin Retail Trust, Keppel Pacific Oak US REIT, CDL Hospitality Trust & Manulife US REIT.

Although not ranked in the top five by net institutional inflow, SGX noted that sixth placer Keppel DC REIT’s performance, which was said to be parallel with the world’s fifth biggest REIT Equinix. The trust generated a 22.2% total return in 2020 YTD, making it the strongest performer of Singapore’s REIT Sector for the period.

Similarly, in the 2020 year-to-date, Equinix Inc has gained 16.8% in SGD terms, and for its FY2019, increased its annual revenue by 10% from FY2018. Since listing in December 2014, Keppel DC REIT units have generated a 180% gain, whilst shares of Equinix Inc gained 200%.

Taking dividend distributions into account, Keppel DC REIT generated a 264% total return, similar to Equinix Inc’s 248% total return in SGD terms.

In 2019, the 43 listed trusts generated an average total return of 3.5%.

Advertise

Advertise