SGX

The Singapore Exchange Limited is an investment holding company located in Singapore and provides different services related to securities and derivatives trading and others.

See below for the latest SGX news, analysis, profit results, share price information, and commentary.

Soochow CSSD joins SGX as Catalist full sponsor and issue manager

SGX now has 15 Catalist Full Sponsors.

Soochow CSSD joins SGX as Catalist full sponsor and issue manager

SGX now has 15 Catalist Full Sponsors.

SGX FX futures hit record volumes in March

The total FX futures traded volume for March was up 20% MoM.

CLI and CDL lead SGX share buybacks in 1Q24

The buyback consideration recorded in 1Q24 was $232m.

SGX watchlist looms for 3 firms after consecutive losses

Of the three, one has recorded a 6-month average daily market capitalisation lower than $40m.

Daily Markets Briefing: STI down 0.52%; Top stock is DBS

DBS is the top despite a 2.258% decrease.

Daily Markets Briefing: STI down 0.77%; Top stock is Singtel

Singtel is the top stock despite a 4.331% decrease.

Daily Markets Briefing: STI up 0.4%; Top stock is DBS

DBS is the top stock with a 0.808% increase.

Daily Markets Briefing: STI up 0.34%; Top stock is DBS

DBS is the top stock despite a 0.333% decrease.

Phillip Capital, China Universal debut China ETF on SGX

It had a launch size of $69m

RHB raises target price for Singapore Exchange

Securities trading remains weak.

Daily Markets Briefing: STI up 0.81%; Top stock is Singtel

Singtel is the top stock at despite ending trading at +0.0%.

SGX derivatives trade volume climbs 24% in February

SGX MSCI Singapore Index Futures volume gained 10% YoY.

SGX to launch interest rate derivatives in H2

These features link Singapore and Japan’s interest rate derivatives.

Manufacturing stocks lodge weakest January performance since 2016

The iEdge SG Adv Manufacturing Index recorded a 6.4% decline.

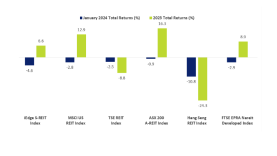

S-REITs post negative returns in January

Total returns of S-REITs were at -4.6%.

Daily Markets Briefing: STI down 1.24%; Top stock is DBS

DBS is the top stock despite a 0.353% decrease.

SGX RegCo proposes rule changes to streamline company restructuring

It suggested eliminating shareholder votes on major disposals during liquidation.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?