UOB

UOB is a bank in Asia that provides a wide range of financial services such as personal financial services, private banking, business banking, commercial and corporate banking, transaction banking, investment banking, corporate finance, capital market activities, treasury services, brokerage and clearing services, asset management, venture capital management and insurance.

See below for the Latest UOB News, Analysis, Profit Results, Share Price Information, and Commentary.

Export decline not tied to global demand, says expert

Non-oil domestic exports fell 20.7% YoY in March.

5 days ago

DBS, OCBC to see net profits dip, loan growth soften in Q1

“Softer NIM but resilient asset quality.”

Two of the largest banks in Singapore are expected to report a year-on-year (yoy) drop in net profits for the first quarter, although their asset quality will remain resilient according to UOB Kay Hian.

6 days ago

Disinflation trends may prompt MAS slope cut

UOB experts said MAS may cut monetary policy slope by 50 bps.

UOB names new head of global group markets and new Hong Kong CEO

Kelvin Ng and Adaline Zhang bring over two decades of experience to their new roles.

NODX to expand by 6.0% in 2024

Economists said base effects will drive recovery in NODX.

Why Singaporeans are okay with locking away over $4b of their money

Customers can only access ‘locked’ money with a physical card or by visiting a branch.

UOB’s Christine Ip reflects on 3-decade banking career and circling back to the arts

Ip believes that finance and creativity go hand-in-hand in building a holistic pool of talents in UOB.

Taylor Swift’s concerts could boost March retail sales by $150m: expert

The pop star will hold six concerts in Singapore in March.

PMI slips to 50.6 in February

It dipped by 0.1 points from January.

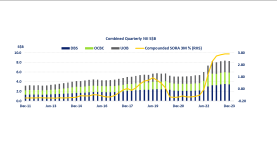

DBS, OCBC, and UOB post combined net interest income of $8.3b in 4Q23

4Q23 marks the 5th consecutive quarter that the combined NII of the big three was above $8b.

Experts unfazed by manufacturing dip, expect mid-2024 rebound

In January, output decreased by 5.7% MoM.

Why Singapore saw softer inflation in January despite GST hike

In January, consumer prices eased to 2.9% YoY.

Analysts keep 2024 growth forecasts steady despite lower-than-estimate GDP

RHB sees the economy rising 2.5%, UOB projects 2.9% growth this year.

What do businesses want from the Budget 2024?

Businesses cited six measures they want from the government.

Retail sales growth to moderate to 1.0% YoY in 2024: expert

Last year, retail sales grew 2.3% YoY.

Singapore leaders pay tribute to late banking tycoon Wee Cho Yaw

Wee was hailed as a visionary leader and for his contributions to education and culture.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?