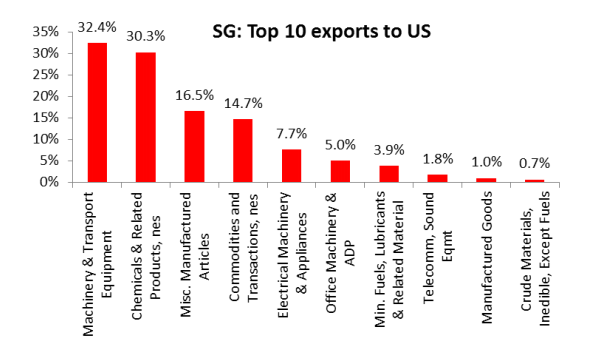

Chart of the Day: Singapore's top exports to US hit by trade conflict tariffs

Industries most likely affected include the electronics, chemicals, and maritime & shipping.

This chart from OCBC Treasury Research & Strategy shows Singapore's top exports to the US. Leading the way are machinery & transport equipment (32.4%), chemicals & related products (30.3%), miscellaneous manufactured articles (16.5%), commodities & transactions (14.7%), electrical machinery (7.7%), office machinery (5%).

Singapore's other exports to the US include fuels, lubricants, & related material (3.9%), telco & sound equipment (1.8%), manufactured goods (1%), and crude materials, inedible, except fuels (0.7%).

"There are certain products that are directly affected by the US tariffs: solar cells and modules, washing machines, steel and aluminium," OCBC said in a report. However, these products account for a relatively modest 0.1% of Singapore's exports.

"Furthermore, for companies that produce intermediate goods used in the production of China’s exports to the US may see softer demand for such goods," the bank added.

Singapore industries most likely affected include the electronics, chemicals, and maritime & shipping industry. "For non-manufacturing sectors such as finance, increased market volatility may drive capital flows and flight to quality," OCBC said.

If overall regional and China-centric trade flows decline, the Singapore economy will likely take a hit due to its dependence on trade and manufacturing activities, it added.

The first leg of US tariffs with effect from 6 July applies to 818 Chinese goods with a total value of US$34b. The second leg, which includes 284 goods amounting to about US$16b of Chinese imports, would come later and be subject to additional public comments.

Advertise

Advertise