March inflation disappoints market expectations: analysts

Transport prices continued its deflationary trend for the last nine months.

Singapore’s inflation pressures continued to stay benign in March after it rose to 0.6% YoY, in turn disappointing market expectations for a 0.7% YoY print, according to a report by UOB Global Economics & Market Research.

Core inflation unexpectedly slowed to 1.4% YoY in the same month, down from the 1.5% YoY pace seen in February. Accounting for March’s inflation, Singapore’s headline and core consumer price indices rose 0.5% and 1.6%, respectively in Q1 2019, against Q1 2018’s headline and core prints of 0.2% and 1.5%.

Also read: Inflation down to 1.4% in March

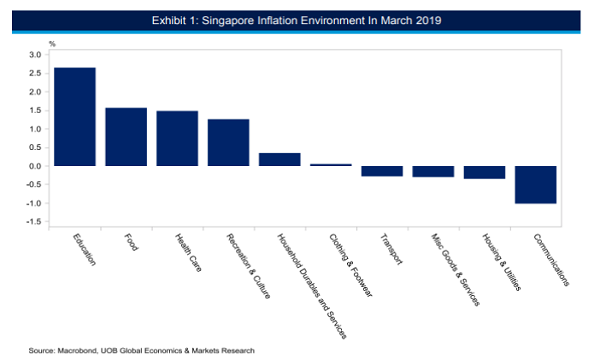

“Unsurprisingly, the drivers, which led to the slowdown in core inflation, were broadly similar to that of the first two months of 2019,” UOB’s economist Barnabas Gan noted, adding that across the clusters, transport prices continued its deflationary trend for the last nine months. “Communication prices declined for its eighth consecutive month, whilst housing & utilities prices fell for its third straight month. Prices of miscellaneous goods and services also declined 0.3% YoY, the first negative print since November 2017.”

The slight uptick in inflation was attributed to higher education, food, health care and recreation & culture prices. The price increase in these clusters continued to outweigh the deflation seen in the other clusters, Gan noted. “Specifically, private road transport costs, a reflection of car prices and petrol costs, declined for its ninth month on a YoYr basis at 0.9% YoY versus February’s print of -2.3%.”

A separate report by OCBC Treasury Research and Strategy further highlighted that since the start of 2019 to mid-April, COE premiums have also risen by some 28% (category A), 49% (category B) and 59% (category E).

“One possible contributing factor for the recent surge in COE premiums could be possibly linked to Go-Jek’s entry to the Singapore ride-hailing market,” OCBC’s Selena Ling explained. “We will need to see if the COE premiums continue to climb from here or stabilises in the coming months.”

Ling also highlighted that one recent development to watch for is the Trump administration’s announcement that it will not renew any waiver on Iranian oil sanctions. Given that Iran, Venezuela and Libya are experiencing larger production outages than expected which is leading to an increasingly tight supply flow, the odds of OPEC+ continuing its supply curtailing programme into H2 2019 is looking very slim.

“Hence, we expect crude oil prices to drift higher from here, with Brent potentially targeting US$78-80 per barrel. This implies there could be potentially some upside risk from crude oil prices on domestic inflation from here,” she said.

Given the relative slowdown in Singapore’s economy led by the global economic uncertainties and weaker external environment, UOB Global Economics and Market Research has downgraded its headline inflation target to 1% from 1.2%, whilst keeping its core inflation outlook at 1.5% unchanged.

Advertise

Advertise