Guess which CEO bought his own shares for $9.5m

He's seeing the company head to the right direction.

Venture Corporation has been doing well with strong double-digit revenue growth for the past three quarters that its CEO Wong Ngit Liong has been making open market share purchases frequently.

According to OCBC Investment Research, Wong has been exercising his employee share options and making open market share purchases on numerous occasions.

He spent $2.1m to purchase 166,300 shares for an average cost of $12.51 per share on 14 July. Three days later, he spent $1.3m again to purchase 105,300 shares for $12.52 per share.

On 12 September, he splurged $6.1m, the largest amount so far, for 400,000 shares at $15.26 each.

Over these three instances, Wong spent a total of $9.5m in open market purchases of VMS' shares.

"In our view, these transactions provide a very clear positive signal of his confidence over where he believes the company is heading towards," OCBC analyst Eugene Chua said.

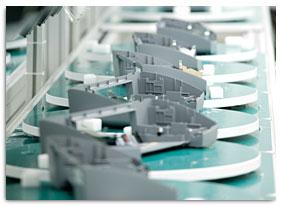

VMS has consecutively posted strong revenue growth for three quarters already, thanks to higher demand in its Test & Measurement/Medical & Life Science/Others (TMO) segment and Networking & Communications (N&C).

Profit for the past eight quarters also posted double-digit YoY growth. In Q2, it surged 61.0%, thanks to margins expansion in addition to higher sales.

Advertise

Advertise