News

Daily Markets Briefing: STI up 0.8%

Daily Markets Briefing: STI up 0.8%

Medtecs International saw the sharpest decline amongst top active stocks with a 3.82% contraction.

Daily Briefing: Singapore, Indonesia begins talks on reciprocal green lane; Government invests $82.95m in Phoenix Mills' QIP

And MSF to strengthen social safety nets amidst pandemic.

IPOS, SBF unveil pilot programme for IP management

It will build upon the Skills Framework for IP launched in 2019.

CAAS allows travellers from Brunei, New Zealand to apply for ATPs

Individuals must do so between seven and thirty calendar days prior to their arrival.

JTC launches 2 sites via tender

The sites at Tampines North Drive 3 and 160 Gul Circle both have a tenure of 20 years.

GuocoLand's profit fell 55% to $114.07m in FY2020

Revenue from investment properties and hotels dropped.

Changi Airport launches deals on online shopping platform

Flash vouchers of up to $118 can be redeemed every Monday.

Chart of the Day: Prime office rents in Raffles Place/Marina Bay down 4.1% in Q2

This is due to landlords lowering their expectations to maintain occupancy.

Daily Markets Briefing: STI up 0.04%

Aspen led the gains amongst top active stocks with a 63.42% expansion.

Daily Briefing: Singapore sees cycling boom amidst pandemic; Scoot modifies A320 aircraft

And Reapra launches a virtual hackathon for female founders.

Singapore permits general travel to Brunei and New Zealand

However, travellers are still subject to a COVID-19 test upon arrival.

Singapore's palpable pickup in new home sales driven by ‘revenge buying' syndrome

Developers moved 1,713 private residential units in Q2, with about 60% of transactions recorded in June.

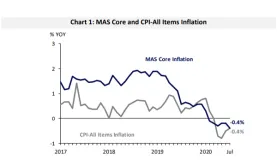

Singapore sees 0.4% deflation in July

Costs of electricity and gas and food saw a steeper decline.

OCBC's Bank Data Certification Pathway gains IBF accreditation

Successful programme participants will now be qualified as data analysts.

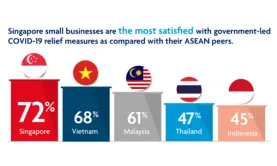

72% of small businesses are satisfied with government efforts

Amongst ASEAN markets, Singapore is the most pleased with the relief efforts.

NETS, Singtel team up to expand digital cross-border payment services

It leverages Singtel’s ConnectPlus Managed Network and AWS’ cloud computing platform.

SATS posts $43.7m net loss in Q1

A decline in aviation volume and loss contributed by the overseas entities dragged profit.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform