Condo sales hit 4,212 units in Q2

New sales volume may hit 8,000 to 10,000 units in 2019.

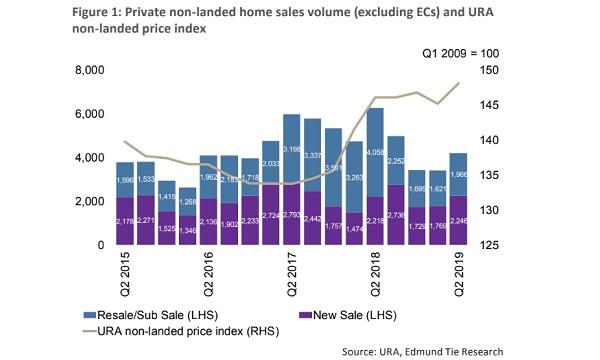

Private non-landed property sales volume hit 4,212 units in Q2, the highest since cooling measures were introduced in Q3 2018, according to a report by Edmund Tie.

New sales volume jumped 30.6% to 2,246 units in Q2, whilst resale volume rose 18.2% to 1,996. In H1, new project sales rose 7.4% YoY to 3,966 units.

The number of new project launches shot up to 16 in Q2 from 6 in the previous quarter, but the total number of units from projects shrank to about 2,700 units compared to more than 4,900 units over the same period. Meanwhile, the sell-down rates of the new projects ranged from 1.7% to 48.9%, but the overall average improved to 19.0% from 10.7%.

Meanwhile, the non-landed price index excluding executive condominiums grew 2.0% in Q2, reversing the from the -1.1% decline in the previous quarter. The price recovery can be attributed to the higher selling prices of newly launched projects in the Rest of Central Region (RCR) Sky Everton and Amber Park, which saw take-up rates of 48.9% and 76.7% during its first weekend launch, respectively.

“The outlook for H2 2019 remains cautiously optimistic with new sales volume likely to achieve our forecast of 8,000 to 10,000 units in 2019, whilst prices are largely expected to stay stable with an upside of up to 3.0%,” the firm said in a report.

On the other hand, land sales value plunged 40.5% QoQ in Q2 2019 due to a fewer number of government land sales (GLS) sites awarded. Only two sites were sold although GLS sites still accounted for the bulk of 87.8% of total land sales during the quarter. This includes a freehold site at 2 Cavan Road and five-unit en bloc site in District 9, sold for $38.7m and $9.3m, respectively.

“Whilst residential en bloc site sales have remained subdued since July 2018, a small five-unit en bloc site in District 9 was sold to a private investor for $9.3m in June 2019, with no immediate plans for redevelopment,” the report added.

The proportion of units sales to foreigners rose by one percentage point to 6.0%, but the proportion of mainland Chinese buyers has been declining since Q2 2018 to 22.0%.

NPRs continue to prefer units in the Core Central Region (CCR), pushing up demand for units priced above $4m in Q2. On the other hand, price sensitive SCs and SPRs leaned towards developments in the RCR and Outside Central Region (OCR).

The proportion of unit sales to Singaporeans (SCs) and Singapore Permanent Residents (SPRs) remained steady. Buyers with Housing & Development Board (HDB) addresses, a proxy for HDB upgraders, rose 16.6 per cent q-o-q in Q1 2019 after two quarters of decline, consequently accounting for about 38.0% of total sales. Median unit prices ranged from $0.9m to $1.1m.

Advertise

Advertise