Condo resale prices up 1.3% in November

Luxury units and big resale condos are reportedly in demand.

Condo resale prices climbed for the fourth straight month in November as transaction volumes continue to improve in tandem with the recovery of market sentiment.

Overall resale prices were 1.3% YoY higher compared to November 2019, according to the latest report by SRX, thanks to price increases in the Rest of Central Region (RCR) and Outside of Central Region (OCR) at 1.8% and 1.4%, respectively.

This was slightly offset by a 0.6% decrease in the condo resale prices in the Core Central Region (CCR).

Pent-up demand and improving market sentiment helped drum up sales, said Siew Ying Wong, head of research and content, PropNex.

“The resale market has rebounded strongly—after a slow Q2 2020—driven by pent-up demand, a better match in price expectations between sellers and buyers, as well as returning confidence as the Singapore economy continues to recover. With the healthy demand coming though, we expect sellers to hold asking price firm or raise the price of more attractive units,” he noted.

Luxury homes and big resale units have also been in demand, observed Christine Sun, head of research and consultancy, OrangeTee & Tie. Attractively priced resale mass market and city fringe homes have also been snapped up, she added.

“Investors around the world are gearing up for a steadier recovery in 2021. Many investors have already looked past current headwinds and are banking hopes on a vaccine success and are optimistic that the global economy may see better days ahead,” Sun said.

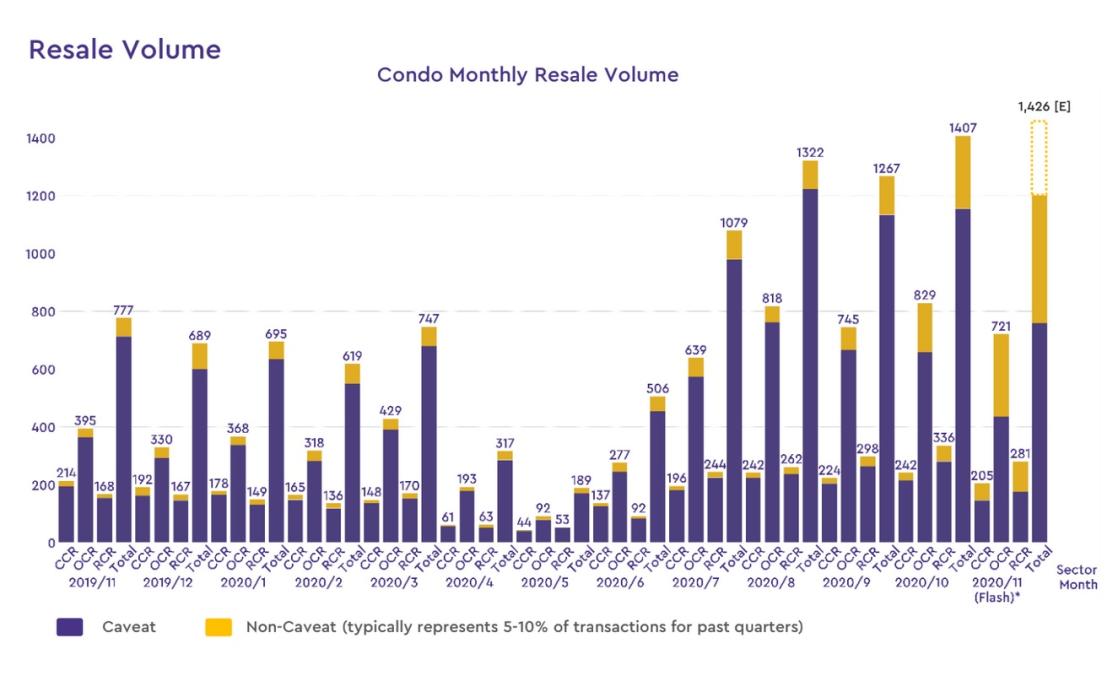

Volume-wise, an estimated 1,426 units were resold in November, 83.5% higher than in November 2019 and a 1.4% increase from the 1,407 units resold in October 2020.

Total transaction volume is also 76% higher than the five-year average volumes for the month of November.

Breaking down by regions, 59.7% of the month’s volumes are from OCR, 23.3% from RCR, and 17% from CCR.

A $11.7m resale unit at Nassim achieved the highest transacted price for a resale unit in November. In RCR, the highest transacted price is a unit at Corals at Keppel Bay that was resold for $6.9m. Meanwhile, a unit at The Chuan resold for $3.6m was OCR’s most expensive condo resold sold in November.

Factoring in URA Realis data reflecting that 7,810 private homes resold in the first 10 months of 2020, the number of private home resale transactions has reached over 9,200 units in the first 11 months of 2020. This has already surpassing the overall private home resale deals of 8,949 units for the whole of 2019, according to PropNex’s Wong.

For the whole of 2020, Wong expects private home resale volume could potentially cross 10,500 units this year.

Meanwhile, Sun forecasts that the sales of resale homes will rise by about 8-10% in 2021, to around 9,000-10,000 units whilst prices are set to climb 1% in 2021.

Advertise

Advertise