Condo resale prices down 0.6% in June

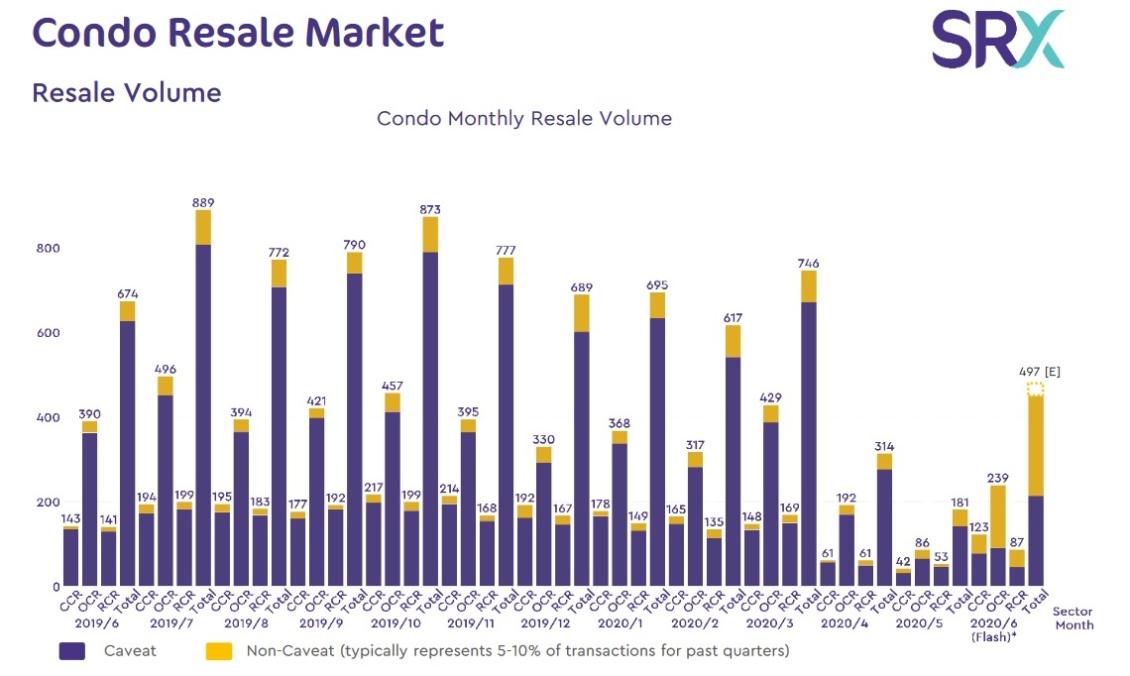

But 178.6% more units were sold during the month compared to May.

Resale prices of private non-landed condominium and apartment units fell 0.6% YoY in June compared to a year earlier, according to a report by SRX.

Condo prices in the core central region (CCR) led the declines, contracting 1.1% YoY in June. Meanwhile, prices in the rest of central region (RCR) and outside central region (OCR) shrank by 0.8% YoY and 0.4% YoY, respectively.

This is despite more units being moved in June compared to May. An estimated 487 units were resold during the month, a 174.6% increase from the 181 units sold in May.

The higher volume of sales was expected given the transition to Phase 2 of circuit breaker measures last month, according to Christine Sun, head of consultancy and research at OrangeTee & Tie.

“The rebound in sales is within expectation given that house viewings resumed after the circuit breaker period ended last month. Last week, the SRX flash estimate for the HDB resale market reflected a similar rebound where close to seven times more flats were sold in June when compared to May after the circuit breaker period,” Sun noted.

However, volumes were still 26.3% lower than in June 2019 and 40.7% lower than the 5-year average volumes for the month of June.

Month-on-month, overall prices remained unchanged compared to May.

Condo prices in the core central region (CCR) and rest of central region (RCR) registered a 1.8% MoM and 1.1% MoM decline, respectively. This was offset by outside central region (OCR) prices rising by 1.4% MoM over the same period.

The highest transacted price for a resale unit in June was the $12.2m apartment at Skyline @ Orchard Boulevard. In RCR, a Floridian unit was resold for $3.9m, whilst a unit at the Tembusu took the cake in OCR, having been resold for $4.6m.

Sun noted that the private resale market quickly picked up in sales last month compared to May thanks to the use of technological tools.

“Whilst many buyers, especially owner-occupiers, would still prefer to make a final inspection of the physical premises before confirming the purchase, some could make a faster decision once house viewings resume after the circuit breaker period ended. Virtual house tours and e-open houses have helped to speed up the buying process for some buyers as they could select and shortlist units remotely prior to the resumption of house viewings,” said Sun.

Sun also observed that more buyers and sellers are willing to negotiate prices due to the lower sales volumes in the past few months, shaving price gap expectations.

“This may also explain why more deals were closed in recent weeks as both parties were willing to lower their price expectations,” she said.

The private resale market is expected to continue improving, barring no second wave of COVID-19 infections and assuming that the economy does not deteriorate drastically, concluded Sun.

Advertise

Advertise