Can Singapore hold firm to its stock market dominance?

Halfway through Q1, companies that reported their results gained 9% YoY, whilst FTSE Singapore beat all other 12 indices in Asia.

Half of the Straits Index Times (STI) stocks that are scheduled to report earnings this reporting season have now released their results, with average net profit after tax growing 9% YoY, SGX Research data as of 30 April revealed.

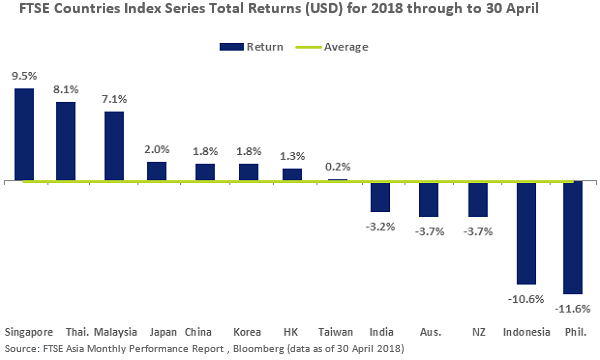

Meanwhile, the alternate FTSE Singapore Index has maintained the strongest return among the Asia Pacific Indices over the first four months of 2018. The FTSE Singapore Index (with 32 constituents) generated a USD total return of 9.5%.

This compared to an average decline of 0.1% for all the 13 Asian Pacific Indices that span 1,000 stocks. Indices and Taiwan and Thailand both gained 8.1%. To compare, in 2017, the FTSE Singapore Index generated a 36.1% USD total return which compared to an average of 31.7% for the 13 Indices.

However, CMC Markets sales trader Oriano Lizza told Singapore Business Review that looking forward, there are concerns that Singapore might not be able to maintain that sort of pace. "It is reliant on the wider geographical performance of Asia and the US as well. I think [companies] are concerned about an economic slowdown," he added.

Lizza also noted that there are many potential trade tariffs or trade concerns when China and the US meet. This has happened just recently when the STI dropped 2.3% after US president Donald Trump said he would impose US$50b-US$60b tariffs against Chinese goods over intellectual property violations.

However, the trader also thinks Singapore has an advantage compared to other markets. "I think the Singapore market is exposed to an extent, but it’s also somewhat isolated compared to other political and geographical regions," he said. "If we look at, for example, Japan, it is very dependent on imports and exports, but the STI seems to be somewhat more balanced in terms of its constituents. In terms of the Hang Seng, they are being weighed down by the Mainland markets and the slower economy as well."

"With Singapore, they obviously have made some adjustments in the dual listing of the companies, trying to encourage further investment. But as they’re not directly connected to other Asian markets which are slowing down and showing downturn or underperformance, they are actually benefiting from that," he added.

Moreover, Singapore banks are currently leading growth due to improved trading conditions in the markets they are exposed in. SGX reported that five of the best performing STI stocks in April are composed of two banks and one shipping firm: Hutchison Port Holdings Trust (HPHT), DBS Group Holdings, and United Overseas Bank.

SGX market strategist Geoff Howie noted that in recent months, banks have been the strongest of the STI Sectors. "In total, the three banks reported that their FY2017 Net Profit totalled $11.9b with the average Return-on-Equity for FY2017 at 10.4%. In the 2018 year through to 25 April, institutional investors were net buyers of the three banks, with inflows totalling $1.1b, following net inflows of $3.4b in 2017 and a net outflow of $155m in 2016," he said.

Lizza explained, "The banking stocks continue to grow YoY as their loan books have increased significantly and they’ve also benefited from the rising income in the commodities market, they’re quite heavily exposed to commodities. Three percent of their loan book is out to big energy players like Keppel and Sembcorp Marine," he said. "The increase in oil prices, energy, and commodities have risen has allowed them to pay loans back. I think they benefit a lot from that."

He added that there is a rising rate environment locally as well as globally. "Any outstanding debt they’ve got are benefiting from that and also there’ll be inflows from people’s investments looking to yield returns," he said.

As a result, banks have generated 18% market capitalisation weighted total returns over the first four months of 2018. However, Howie noted that the materials sector (which does not have STI representation) beat the former and returned 20%.

"The gain by the comparatively smaller Materials sector has been led by chemical related and industrial metal related plays that are based in China," he said. "Whilst the IT Sector declined 14% in April, it has still maintained a 14% gain for the first four months of 2018. Also, the Healthcare Sector has rebounded somewhat after a somewhat subdued 2017, with 9% gains in the 2018 year through to the end of April," he added.

"The STI is a highly competitive and diversified benchmark index," Howie concluded. "Just as Singapore has been amongst the strongest advanced economies in recent quarters, the STI has generated comparatively strong gains."

Advertise

Advertise