Singapore's LNG scene hits multi-month low in April: Fitch Solutions

It came on the back of spot prices in the Asia LNG market being at its lowest point.

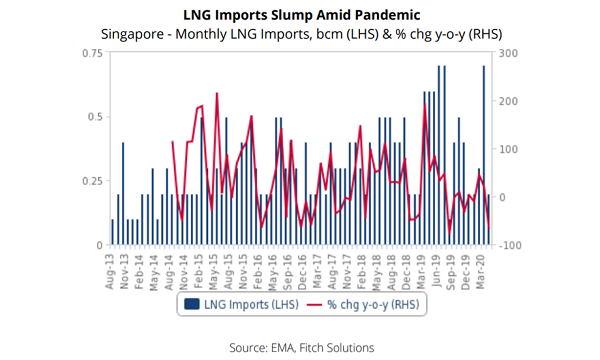

Singapore’s monthly liquefied natural gas (LNG) imports plunged 68% in April, marking the second largest yearly contraction on record, according to a Fitch Solutions report. Year-to-date (YTD) imports through the first four months of the year came in at 1.3 billion cubic metres (bcm), down 14% from the same period a year ago.

The substantial contraction in imports came on the back of spot prices in the Asia LNG market being at its lowest point. Contracted pipeline import volumes also remained relatively stable, which indicates weaker domestic demand.

“Indeed, economic disruptions stemming from the COVID-19 pandemic have fed through to sharply lower gas demand in the power, industrial and commercial sectors around the globe, and Singapore has not proven to be an exception. LNG demand was little buoyed by increased consumption amongst households, gains in the segment were not nearly enough to offset larger declines elsewhere,” Fitch Solutions said in a note.

It also noted that the collapse in Singapore’s LNG demand coincides with the start of circuit breaker (CB) measures. The closure of public venues and non-essential businesses have hurt gas demand, Fitch Solutions said, mostly owing to the significant consumption that occurs amongst industrial and commercial sector users. The report cited government’s statistics where commercial and services sectors account for 81% of total domestic gas demand.

“The households segment has proven a silver lining as sales within the segment were likely boosted by lower tariffs, issuance of government utility bill credits for local households and more people staying home. Certain home-based businesses such as food delivery were also permitted to resume in May. That said, the households’ share in the gas use mix is small at about 13% of total gas consumption,” Fitch Solutions added.

But following this, the gradual lifting of CB measures is expected to bring an uptick in gas demand as normal economic and industrial activities resume. However, its recovery will not be as smooth, as Singapore’s LNG scene is still ladened with challenges amidst resurging signs of bilateral tensions between the US and China.

Amidst these uncertainties, the long-term outlook for both gas demand and LNG imports is still positive due to favourable government policies, noted Fitch. “The use of gas looks set to increase at a stable rate over the coming years, as the government's desire to reduce carbon dioxide and sulphur emissions drive continued reliance on gas-generated power.”

Uses across the transport, industrial and shipping sectors are also expected to grow as gas is embraced for its cleaner burning nature. The report added that the lack of domestic production forebodes even deeper reliance on imported LNG, more so as Singapore prepares to wean off pipeline gas supply from neighbouring Malaysia and Indonesia which currently dominate the domestic gas supply.

“Singapore has made efforts to diversify its LNG sources and refrained from signing long-term contracts, instead relying on purchasing from global portfolio firms and trading arms of IOCs, and such procurement strategy is likely to be maintained over the coming years, amidst ample supply and subdued prices,” Fitch Solutions said.

As a result, Singapore’s LNG import capacity may likely be in line to be further expanded to accommodate growing demand.

Singapore reportedly has the capacity to import 11 million tonnes per annum (mtpa) or 15bcm of LNG per annum following the completion of the phase III expansion at its Jurong Island LNG regasification terminal in September 2017, according to Fitch. A fourth train expansion has been mulled for the project for completion by 2026, as the government is looking to take on an expanded role as regional hub for LNG trades and bunkering solutions.

A fifth LNG train has also been previously proposed to be developed in the country’s east coast, although no plans have been formalised as of now.

Advertise

Advertise