Chart of the Day: Which bank is most exposed to the struggling oil and gas sector?

Bad loans will tick up as oil prices collapse.

Singapore's largest banks should prepare for more non-performing loans (NPLs) as oil prices drop to their lowest level in twelve years, according to a report by Maybank Kim Eng.

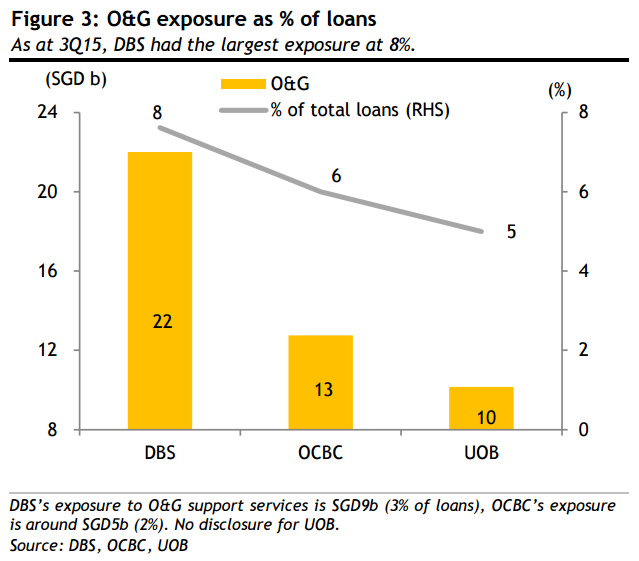

DBS is most exposed to the oil and gas sector. Its loans to O&G players amount to $22 billion, making up 8% of its loan book. DBS also has $9 billion worth of loans to oil and gas support services players, making up 3% of loans.

Meanwhile, OCBC has $13 billion of loans to the oil and gas sector, making up 6% of its loan book. It also has around $5 billion of loans to O&G support services providers, amounting to 2% of its total loans.

United Overseas Bank (UOB) has the smallest exposure to the sector. Its total O&G loans amount to $10 billion, making up 5% of its loan book. UOB did not disclose the amount of loans it has disbursed to O&G support services players.

In terms of other commodities excluding oil and gas, OCBC has the largest exposure to the commodities sector at $15 billion, or 7% of its loan book. This is followed by DBS with $12 billion, or 4% of its loan book, and UOB with $6 billion, amounting to 3% of its total loans.

"Asset quality deterioration for Singapore banks will linger, especially on their exposure to O&G and commodities,” Maybank Kim Eng said.

Advertise

Advertise