Businesses still bearish for Q3 2019

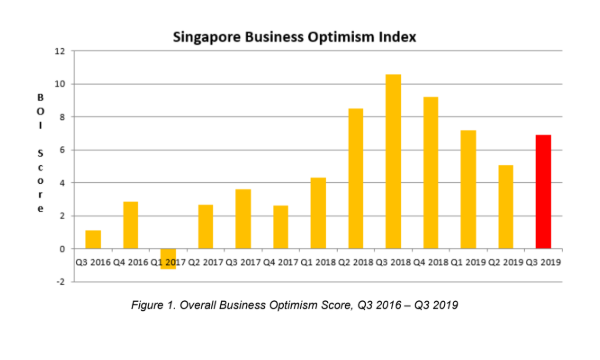

The business optimism index fell from +10.58ppt to +6.91ppt over a year.

Business sentiment amongst local firms has remained tepid for Q3 2019 despite a slight rebound for the first time after three consecutive quarters of decline, according to the Singapore Commercial Credit Bureau (SCCB) Business Optimism Index.

BOI has inched marginally upwards from +5.08ppt in Q2 2019 to +6.91ppt in Q3 2019. On a YoY basis, BOI sharply fell from +10.58ppt in Q3 2018 to +6.91ppt in Q3 2019.

As with Q2 2019, five of six indicators are expansionary for Q3 2019 and have risen on a QoQ basis, including volume of sales, net profits, new orders, employment, and inventory. Only selling price fell into the negative zone.

On a YoY basis, only two of six indicators have improved for Q3 2019, including net profit and employment. The other indicators, including volume of sales, selling price, new orders, and inventory levels, fell into the negative zone.

SCCB noted that the services sector has emerged as the most optimistic sector, with all five indicators in the positive region for Q3 2019. Five of its indicators (volume of sales, net profit, new orders, inventory, and employment) have risen upwards.

The financial services sector trailed the services sector to be the second most optimistic sector, with four indicators in positive territory. However, four of six indicators (volume of sales, employment, selling price, and inventory) have also moderated downwards for Q3 2019.

Sentiments within the construction sector saw moderate improvements for Q3 2019, with three indicators in the expansionary zone. The indicators for volume of sales, employment, and selling price all rose, whilst the indicators for net profits, new orders, and inventory dropped.

Meanwhile, the transportation sector saw a downward moderation due mainly to a contraction within the water transport segment. Five of six indicators have moderated downwards for Q3 2019. Volume of sales, net profits, and employment levels plunged into the negative zone, new orders moderated downwards, whilst selling price and inventory rebounded to 0ppt.

The manufacturing sector is one of the least optimistic sectors due to a slowdown in the semiconductors sub-segment. For Q3 2019, five of the six indicators are in negative territory.

Volume of sales and net profits dipped, whilst inventory levels, employment levels, and new orders were in the negative zone. Only selling price rebounded for the quarter.

SCCB CEO Audrey Chia commented, “Despite the slight rebound in sentiments amongst local firms, we are cautious in our expectations for the next quarter. Downside economic risks are mounting with the ongoing trade tensions between the US and China and the growth outlook remains uncertain globally.”

“On the domestic front, we are also expecting lukewarm sentiments among manufacturers as the sector faces continued headwinds, with market maturity and global trade issues posing particular challenges for the electronics and precision engineering sectors,” she added.

However, Chia also said that the services sector will still remain a key pillar growth for 2019, driven largely by an expansion in the business services, information and communication sub-sectors.

Advertise

Advertise