Banks stand strong against bad loan wave in Q1

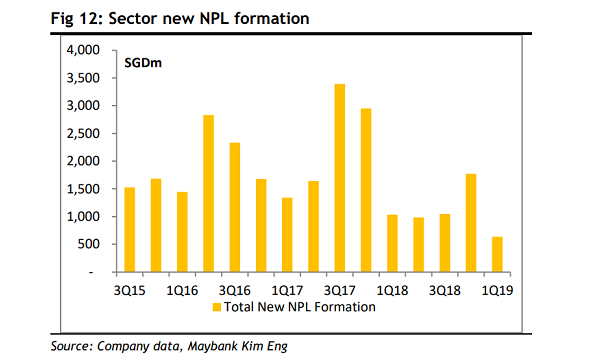

The formation of new bad loans in Q1 was the lowest in five years.

Despite heightened concerns about the impaired ability of companies to repay their debt, banks in Singapore were able to maintain healthy asset quality with new non-performing loan (NPL) formation falling to its lowest point in five years, according to a report from Maybank Kim Eng.

With healthy cashlflow and clear re-payment outlook, banks are set to maintain this positive momentum as even the retail and SME segments, which are historically more sensitive to economic downturns, posting healthy asset quality figures. SME exposures accounted for around 5-10% of the banks’ total loans by end-2018.

"This is likely driven off strong domestic consumption stories in the markets the banks are operating in and the continued expectations of positive GDP growth. Despite US-China trade war uncertainties, GDP growth has not been cut to negative in any key markets by MKE’s economics team," analyst Thilan Wickramasinghe said in a report.

In particular, gross NPLs of DBS should continue to fall from an O&M sector driven flare up of 1.7% in 2017 to an expected 1.4% in 2021.

However, credit charges are not expected to dip but are tipped to stay level or increase slightly given the deepening uncertainties.

Advertise

Advertise