/Calastone

/Calastone

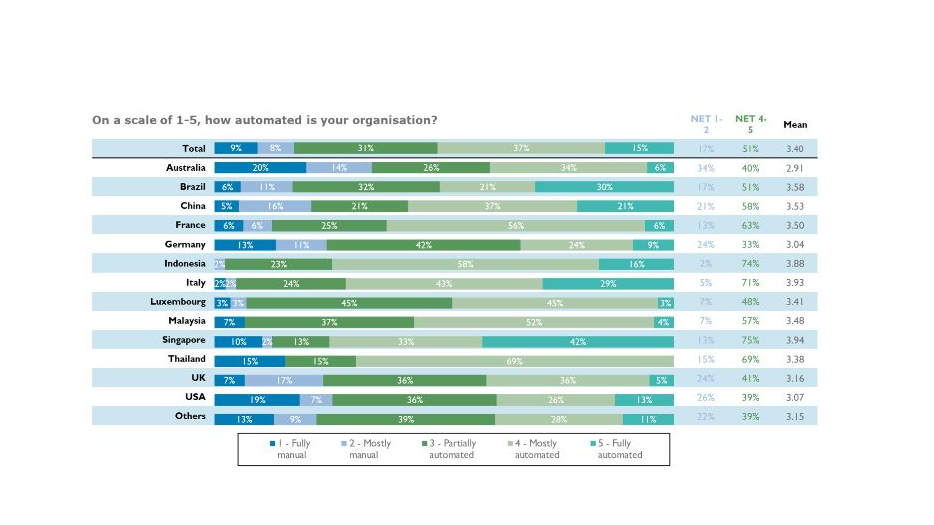

Chart of the Day: 10% of fund managers' businesses are still unautomated

Asset servicers are less likely to be manual than investment managers.

About 42% of mutual fund investment managers and asset servicers from businesses in Singapore said their organisations are fully automated, with 10% said they are fully manual, a recent Calastone report showed.

This chart from Calastone also revealed that 33% are mostly automated, 13% are partially automated, and 2% are mostly manual.

READ MORE: Chart of the Day: Singaporeans leave their money to savings and insurance

Study shows half of SMEs not applying for gov’t incentives for digitisation

When analysed, Calastone said asset managers are less likely to use manual processes than investment managers.

“This makes sense when considering the administrative nature of the processes they’re responsible for and their main role. That is, to remove complexity and streamline processes for fund managers,” read the study.

Almost 600 mutual fund investment managers and mutual fund asset servicers or administrators from global markets, including Singapore, were interviewed for this report.

Advertise

Advertise