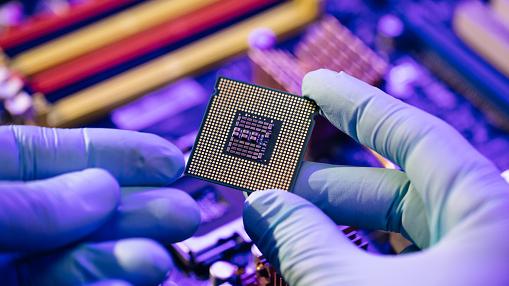

Semiconductor segment to see better numbers in 2022F

The improvement will be driven by the easing of the global component shortage.

Singapore’s manufacturing sector, particularly the semiconductor segment, will likely see better numbers in 2022F as the global component shortage is expected to ease in 2H22, RHB said in a report.

According to the analyst, the alleviation of the shortage of parts, which has affected the sector in the last years, may also lead to a positive rerating for the sector.

The ship shortage has pushed the global semiconductor equipment billings to surge 38% YoY to $36.4b (US$26.8b) in 3Q21, marking an 8% QoQ rise to register a fifth consecutive quarterly record high.

“About 29 new tech fabrications have been planned for construction in the next few years, which should ensure high demand. Equipment spending for these 29 fabrications – 19 have already started construction, and the rest are likely to break ground in 2022 – will likely surpass USD140bn over the next few years,” RHB said.

“As a result, we remain positive on the semiconductor supply chain, and expect Frencken to continue to be a major beneficiary of this trend – just as it has been so far,” the analyst added.

Apart from a better supply of parts, RHB also sees capital market support measures to boost investor sentiment in the sector, which have been negatively impacted by events such as the Russo-Ukraine war and crackdown on China tech stocks.

Last year, however, China announced that it will “actively unveil policies that are favourable to money markets” which RBH believes would have “a positive impact on the sentiment on global tech stocks – and should also spell a positive outlook for Singapore’s tech counters.”

Meanwhile, RHB said manufacturers which saw strong demand last year like Venture, will do much better in 2022.

1 SGD = 0.74 USD

Advertise

Advertise