News

Prime retail rents stay flat in Q4 2019

Prime retail rents stay flat in Q4 2019

Online platforms and slower sales dampened retail sales.

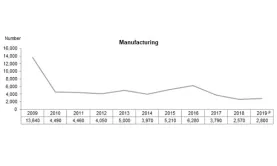

Chart of the Day: Layoffs in manufacturing sector grew to 2,800 in 2019

All sectors’ retrenchments rose in Q4.

Daily Markets Briefing: STI down 1.55%

OCBC Bank saw the sharpest decline amongst top active stocks with a 1.9% contraction.

PayPal refreshes its Singapore Innovation Lab with tech offerings

It has a facial recognition system to register guests to its in-house Augmented Reality-supported bar.

CHIL reduces prematurity risks through data analysis

The platform can monitor the early onset of morbidities of an infant.

Property rule easing may prompt regulatory shift: report

Analysts note that Singapore could be willing to address developers’ concerns.

CRCT sells interest in company holding CapitaMall Erqi for $165.2m

It would allow the company to avoid downtime from refurbishing the 15-year-old mall.

Government likely to allocate $700m in nCoV relief packages

The budget deficit could widen in FY 2020 along with increased government spending.

ST Engineering launches geospatial analytics platform

It is designed to provide immediate streaming access to satellite images.

Listed housing devs with ‘substantial connection to Singapore' to be exempted from QC

Changes will be implemented with immediate effect and reflected in legislation later this year.

Sungei Kadut to pioneer Singapore's manufacturing industry: Chan Chun Sing

The MTI minister plans to make the area more open to new industries and R&D centres.

Elite Commercial REIT joins the SGX Mainboard

It was listed under the stock code MXNU.

Singapore, US to support financial data cross-border transfer

It will be allowed as long as financial regulators have access to data.

Sembcorp Industries to record $245m material impairments in Q4 2019

It expects its energy business to see a net loss.

Frasers' subsidiary creates $186.1b multicurrency debt issuance programme

Net proceeds from the issued securities will be used to finance future acquisitions of the company.

SingPost profits slumped 39.3% to $30.49m in Q3

A decline in domestic letter mail volumes dragged down its revenue.

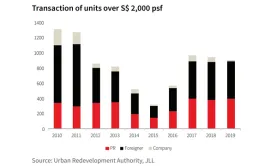

Chart of the Day: Foreigner-bought posh home sales held steady in 2018-19

The hiking of total buyer stamp duty did not seem to have fazed foreign buyers.

Advertise

Advertise

Commentary

Singapore’s family offices: Time to professionalise or risk falling behind

Liquidity crucial to stock market reform