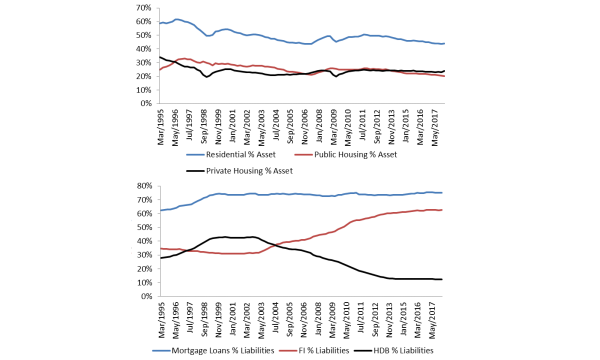

Chart of the Day: Home property assets fall whilst mortgage loans stay up

Home assets as part of total household assets have fallen from 50.5% to 44% in 7 years.

This chart from OCBC Bank shows that from a household balance sheet perspective, home property assets as a percentage of total household assets has fallen from 50.5% in September 2011 to 44.0% in March 2018, whereas mortgage loans (including HDB) has stayed above 75% of total household liabilities for six straight quarters out to March 2018 (September 2011: 73.7%).

"This suggests that either other financial assets (stocks etc) has grown at a faster pace and property assets have not kept up," OCBC said. In addition, most household liabilities pertain to mortgage loans, albeit net household asset position remains very healthy.

The timing of the latest cooling measure was a bit earlier than expected, the bank noted. "From the policymakers’ perspective, being pre-emptive is probably a merit, especially since the private residential property index gains had accelerated significantly since QoQ growth bottomed around mid-2017. The last time growth momentum was higher than 3% was back in June 2011," it added.

Moreover, most of the existing cooling measures in Singapore had not even been lifted yet, and still, the price appreciation is picking up speed. "This is on top of rising domestic interest rates which will impact mortgage rates as well. Hence, it may be deemed as 'euphoria' and a bubble in the making by policymakers," OCBC added.

"In light of this anticipation, Singapore policymakers may have preferred to adopt a 'nip it in the bud' philosophy rather than allow it to bubble over and subsequently take even more draconian measures down the road," it concluded.

Advertise

Advertise