Big three banks average 4.2% total returns in August: SGX

OCBC, DBS, and UOB maintained a combined net interest income of $5.4b in Q2.

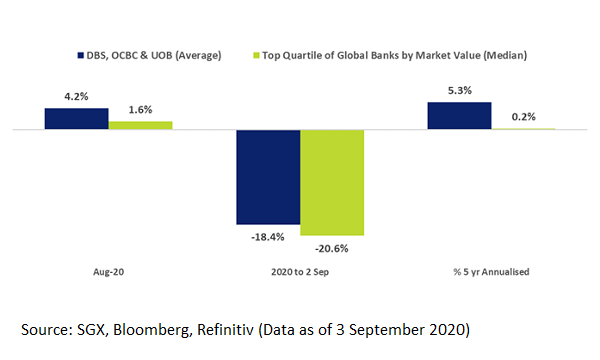

Singapore’s big three banks averaged 4.2% total returns in August, outpacing the 1.6% median total return of global banking stocks, according to data from the Singapore Exchange (SGX).

OCBC, DBS, and UOB have outpaced the top quartile of global banking stocks over the past five years with their 5.3% return vs. the 0.2% return of global banking stocks.

The lenders’ quarterly net interest income surpassed $5b in Q2 2018 and maintained a combined net interest income of $5.4bin Q2, noted SGX.

Global banks’ have been beset with challenges in 2020, what with the onslaught of the COVID-19 pandemic that resulted in lockdowns across markets. This caused central banks to cut rates and introduce accommodative policies to support their economies.

“This year accommodative monetary policy and economic lockdowns have meant that global banks have had to contend with a sudden reduction in interest rate margins and overall demand for financing, while needing to boost loan provisions,” SGX noted in its report.

Amongst key banking sector themes to watch in the second half of the year include banks’ abilities to generate income, tier 1 capital to risk-weighted assets and non-performing loan ratios.

Advertise

Advertise