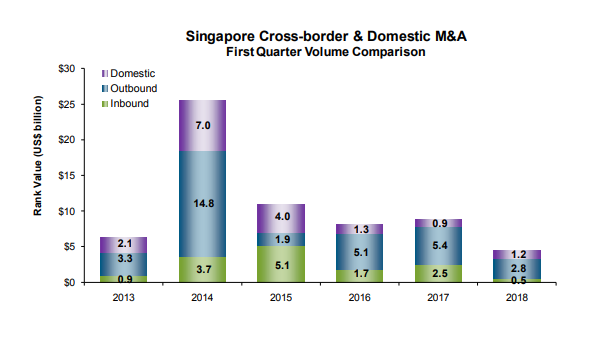

Chart of the Day: Value of Singapore inbound M&A hits 6-year low

It reached US$516.8m, the slowest start to a year since 2012.

This chart from Thomson Reuters shows that foreign acquisitions targeting Singapore-based companies reached US$516.8m in terms of deal value, the slowest start to a year since 2012 (US$227.2m).

According to preliminary data, the industrials sector led inbound activity (US$228.6m) but declined 45.6% over a year. It was followed by consumer products and services (US$128.5m) and healthcare (11.4% of market share).

Meanwhile, Singapore outbound M&A totalled US$2.8b so far this year, down 47.6% in deal value, as the number of outbound acquisitions declined 29.9%.

The materials industry is the most targeted sector thus far (US$905.4b) followed by financials (16.6% market share) and media & entertainment (12.3% of the market). Real estate, which accounted for the majority of the market share in 2017, slipped to fourth place with 11.3% market share.

Meanwhile, domestic M&A activity jumped 30.3% to US$1.2b, despite a 34.6% decrease in the number of domestic transactions. Financials (28.8%), consumer products & services (24.0%), and industrials (22.2%) sectors accounted for a combined 75% market share of Singapore’s domestic M&A activity.

Advertise

Advertise