Check out Singapore's top 10 retailers: study

Actuals movements amongst retailers showed mixed results.

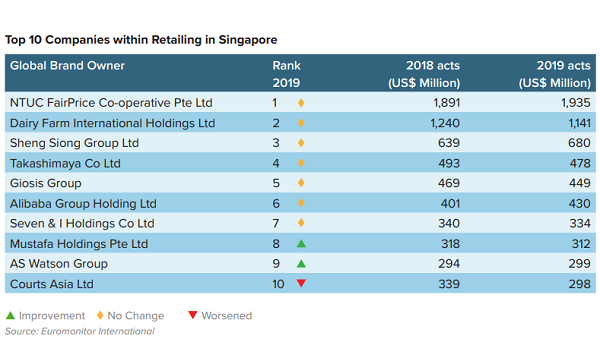

NTUC FairPrice was crowned as Singapore’s top retailer, with its actuals amounting to $2.74b ($1.94b) in 2019, according to Euromonitor’s Top 100 Retailers in Asia 2020 report. Dairy Farm nabbed the top two spot with $1.61b ($1.14b), and Sheng Siong rounded up the top three with $962.4m ($680m).

Other retail firms mentioned in the list are Takashimaya, Giosis Group, Alibaba Group Holdings, Seven & I Holdings, Mustafa Holdings, AS Watson Group and Courts Asia. Actuals movements across the top ten have been mixed.

Overall, Euromonitor observed that Singapore’s retail sales registered a slight decline in 2019 as the economy continues to look gloomy, and a weaker consumer sentiment from the pandemic is projected to linger into 2021.

Currently, retail sales are bolstered by e-commerce sales as consumers perceive the online platform to provide more cost savings and better value for money. The retail landscape is expected to recover slowly in 2021 when the economy is likely to improve and consumers will have higher disposable incomes, Euromonitor said.

Furthermore, the report added that experiential retail is still on the rise as it provides consumers with personalised experiences, which creates better brand identity and relationships with customers.

“Despite physical retail stores not performing well, many e-commerce players are taking their business offline too to maintain their growth. Ultimately, Singaporean consumers still prefer to see and feel items before buying and having a physical store allows consumers to do just that,” Euromonitor stated.

Offline presence allows e-commerce players to provide value-added services for their consumers and build stronger brand identities that were not possible to do so online. “This is especially common for fashion e-commerce players, such as Love, Bonito and Pomelo, which opened their new flagship stores in shopping malls,” it added.

Advertise

Advertise