LNG imports to triple and displace pipeline gas within 10 years

The government has pushed LNG use in power and shipping sectors.

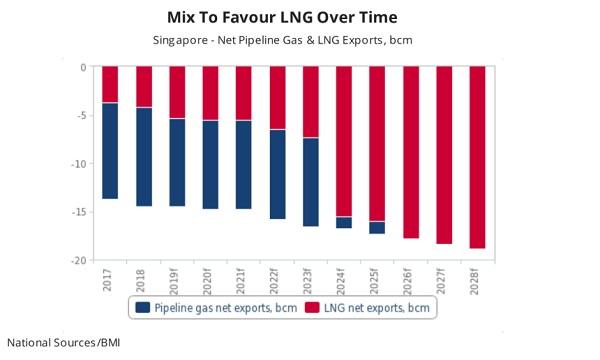

Singapore’s imports of liquefied natural gas (LNG) is set to more than triple by 2028 and displace pipeline gas imports by 2026, fuelled by its increased use in the power sector and shipping industry, according to a report by Fitch Solutions.

With the government advocating for natural gas use to meet emissions cut and decarbonisation goals, the power sector, which is already 97% reliant on gas-fired generation, is expected to source predominantly on LNG.

The Maritime Port Authority (MPA) is also pushing to hike the use of LNG as an alternative shipping fuel, with the International Maritime Organization (IMO) calling to cut CO2 emissions in half by 2050 from 2008 levels. It also brought in incentives for ships to install engines using alternative fuels like LNG.

“Amongst Asia’s net LNG importers, Singapore’s LNG uptake growth will be the most robust, surpassing the likes of Bangladesh, India and Pakistan,” the report stated.

LNG bunkering is also projected to create 15-30 million tonnes per year (mtpa) of demand globally by 2030, according to industry estimates. In addition, MPA pledged monetary support for the construction of LNG vessels, with two vessels set to be in operation by Q3 2020.

Although a global wave of liquefaction projects and slowing demand growth in key growth markets will hold back LNG prices, Singapore’s portfolio is fortunately found to be flexible, with about three-fourth of its LNG imported and the rest procured on shorter-term deals and spot purchases.

In contrast, the share of pipeline gas imports from Malaysia and Indonesia, which has accounted for about 70% of Singapore’s total over the past decade, has been declining since the start of LNG imports in 2013.

“Complications may ensue in the short-term, as the current slate of pipeline gas contracts are mostly indexed against HSFO. Demand and prices for HSFO are expected to precipitate in the quarters ahead... A substantial deterioration in fuel oil prices could trigger attempts to renegotiate, potentially leading to pricing, supply dilemma,” Fitch said.

Advertise

Advertise