GrabPay integrates MyInfo into user verification process

The new feature will be available to all users by end of June 2019.

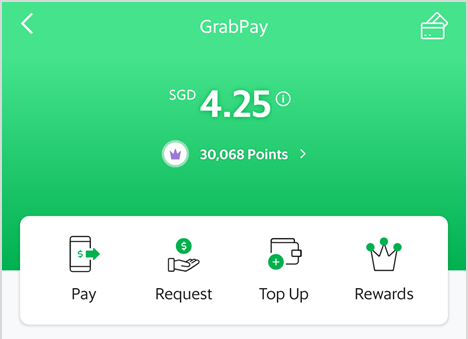

Grab partnered with the Government Technology Agency of Singapore (GovTech) to launch a user verification feature on its GrabPay wallet that allows users to authorise the retrieval of personal data from MyInfo, GovTech’s digital identity service.

According to an announcement, the new feature will be progressively rolled out and will be available to all users by end-June 2019.

As a regulated e-wallet, Grab is now required to perform customer identity verification on GrabPay users through Know Your Customer (KYC).

“Today, three-quarters of our customers use GrabPay daily and close to 9,000 merchants accept GrabPay as a payment option. As we roll out more services and give our users more reasons to go cashless, we know that it is important to ensure that they can do it with a peace of mind. The new user verification feature will help to further strengthen GrabPay’s security,” said Gary Wong, head of GrabPay Singapore.

MyInfo, on the other hand, reduces manual form-filling and eliminates the need to submit supporting documents such as photos of the NRIC.

To perform authentication with MyInfo, GrabPay users simply need to log -in to their SingPass account via the Grab app and provide consent to the retrieval of personal data. Users will receive a notification when Grab has verified and upgraded the account within three working days.

Advertise

Advertise