S-REIT

Are S-REITs still a safe haven amidst rising rates?

A 100bps rise in base rates leads to a 2-3% drop in DPU.

Are S-REITs still a safe haven amidst rising rates?

A 100bps rise in base rates leads to a 2-3% drop in DPU.

REITs: Top 10 outperformers for first half of May

The normalisation in Singapore has bode well for REITs in the retail sector.

4 reasons why S-REITs make a good investment

There is more to S-REITs than just being a good inflation hedge.

Will a looming recession in the US shake S-REITs?

The US yield curve—an indicator of recession—has been inverted since 1 April.

FSTREI grows 0.5% in the past two weeks

UOB Kay Hian said this showed the resiliency of Singapore REITs.

4 factors mitigating inflation’s impact on REITs

Two of these factors are related to utility costs.

ESR-REIT and ARA LOGOS unitholders to discuss proposed merger

The meeting will be held on 21 March 2022.

S-REITS see shaky performance in 2022

The previous year saw 6% in total returns for 2021.

Singapore REITs vs Malaysian REITs: Which will be better to invest in this 2022?

RHB said both are financially stronger to cope with increasing interest rates.

S-REITS well-positioned to weather interest rate hikes: RHB

This after S-REITs delivered a modest 6% in total returns in 2021.

SGX welcomes CSOP iEdge S-REIT Leaders Index ETF

The ETF will be focused on liquidity and S-REITs.

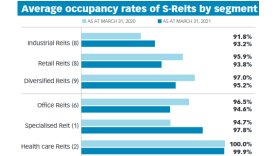

Chart of the Day: Singapore REITs' average occupancy rates dip to 95%

In particular, retail and office S-REITs saw the largest drops in occupancy rates.

Reopening seen driving DPUs of S-REITs in 2021 2H

Maybank Kim Eng backs the reopening of Singapore as the May outbreak receded.

Advertise

Advertise

Commentary

AI is revolutionising learning: Why should educational institutions in Singapore embrace this change?

Seeking an office space in Singapore: Where do you start?