Banks brace for higher risk weighted assets

RWAs could increase by 25% by 2022 and 80% by 2027.

Banks in Singapore are expected to post a mild increase in risk weighted assets (RWAs) especially from low-risk portfolios under Internal Ratings Based (IRB) approach such as mortgages, according to a report from Moody's Investors Service.

The Monetary Authority of Singapore (MAS) proposed to adopt Basel output floors from 2022-2027 in phases. RWAs could surge by 25% in 2022 and then by 80% by 2027, according to projections from the firm, although banks have significant time to adjust as the largest RWAs increase will happen eight years from now.

"The increase in RWAs will be balanced by RWA savings for some other portfolios and risks, and spread over a long period of time, giving the banks time to adjust. We do not expect any significant deterioration in the Singapore banks’ strong capital ratios," Moody's said.

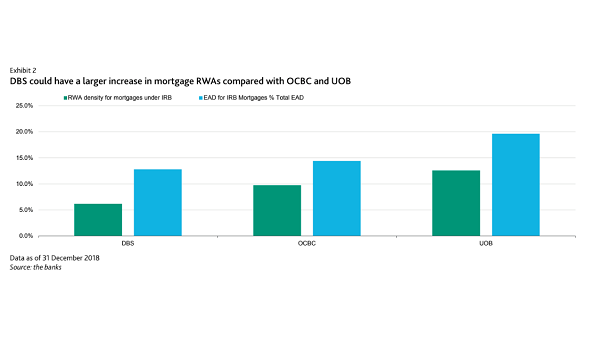

Of its peers, DBS could post the largest increase in mortgage RWAs as its current mortgage RWA density is the lowest at 6%.

RWA inflation could also come from IRB exposures. Under the new SA, unrated corporate exposures will have 100% risk weight which translates to 72.5% risk weight under the fully implemented floor. In a similar development, DBS has the most significant exposure to corporate lending and RWA density for corporates under IRB is also lower compared to OCBC and UOB.

Also read: Singapore banks turn to corporates for loan boost as mortgages weaken

Despite the projected increase in RWA, banks are expected to post RWA savings to soften the overall impact from output floors. Lenders calculate market and operational risk using SA which leads to lower RWA under the floored approach.

"[B]anks will migrate part of their SA exposures to IRB," Moody's observed. "OCBC is best positioned to benefit from such migration, because its SA RWAs formed 30% of total RWAs (credit risk only). This is because its large subsidiary OCBC Wing Hang Bank is currently under SA. OCBC has guided that IRB transition for this subsidiary will happen in 2020."

For the corporate IRB book, RWA savings might be realised because of lower LGD. In 2022, Basel recommends the application of a 40% LGD for unsecured corporates, instead of 45% previously. DBS is better positioned in this case because its average LGD for corporates was 44% at the end of 2018, while UOB was at 43% and OCBC at 42%.

Advertise

Advertise