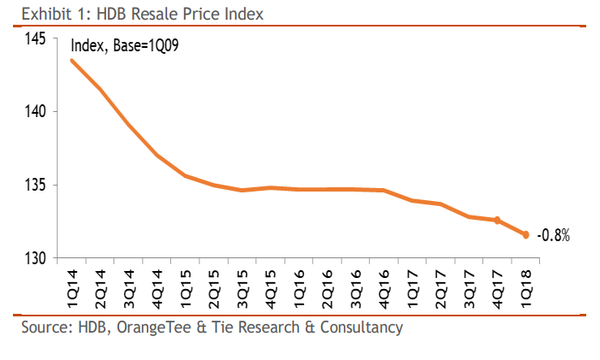

Chart of the Day: HDB resale prices down 0.8% in Q1

This marks the fastest quarterly decline in three years.

The prices of resale flats continued their downward trend after dropping 0.8% QoQ and 1.7% YoY, according to Orange Tee Research, representing the fastest quarterly decline since the first quarter of 2015.

Resale volume similarly dipped 22.3% QoQ to 4,458 units in Q1. On a yearly basis, resale volume edged down 1.6% YoY but remains slightly above the five-year average of approximately 4,250 units typically sold in the first quarter of each year.

Resale prices of HDB flats in Bukit Merah, Toa Payoh, Jurong East and Jurong West falling across most room types.

Rents also fell by 0.7% QoQ, after two preceding quarters of decline. The oversupply of resale flats and the closing gap between public and private home rentals (especially mass-market homes) are likely to add further downward pressure on rents. Leasing volume rose 3.9% q-o-q, and 17.4% y-o-y in Q1.

"We expect HDB prices to stabilise in the months ahead on the back of more positive macroeconomic conditions. Resale volume should also pick up as prices continue to moderate and more HDB owners put up their units for lease as they wait for a market recovery," Orange Tee added.

Advertise

Advertise