The faint smell of recession

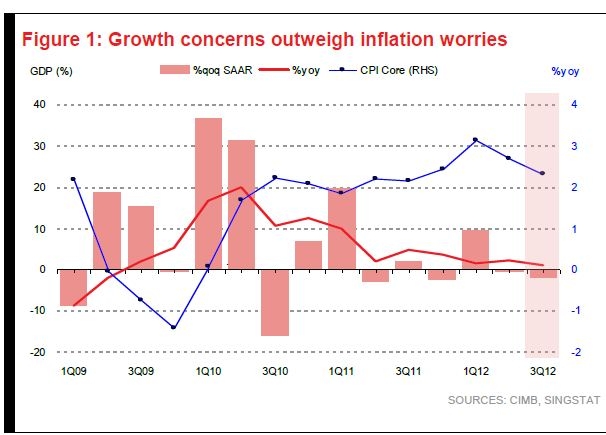

This chart suggests economic growth concerns outweigh inflation worries.

According to CIMB. weaker orders, output and a slower service sector likely tipped Singapore back into a technical recession in 3Q12, with a potential 2% sequential economic contraction (-0.7% in 2Q12). While core inflation remains a threat the risks are now skewed to a recession, it said. "As such, the MAS is likely to take a more dovish view and allow the S$ to appreciate slower. Flash 3Q12 GDP estimates and the MAS’s monetary-policy statement are likely to be released on or before next Friday, 12 Oct," it added.

Here's more from CIMB:

Manufacturing and service sectors disappointed again

After a 4-year reprieve, the Singapore economy is likely to fall back into a technical recession (two straight quarters of contraction). Annualised and seasonally adjusted (SAAR), the economy likely shrank 2% in 3Q12 (-0.7% in 2Q12; +9.5% in 1Q12). The main drag was a 5% fall in the goods sector on weaker manufacturing output (weaker transport engineering, bio-med and tech). Dimmer global-growth prospects have also affected Singapore’s service-producing sector, which dipped 0.5% in 3Q12 (-0.6% in 2Q12). A challenging year-ago base (+5% yoy in 3Q11) likely pulled 3Q12 GDP growth down to about 1% yoy, its slowest since the tail end of the 2008/09 global recession. This would lower 9M12 GDP growth to 1.5% yoy (+1.8% in 1H12), at the lower end of the official growth forecast of 1.5-2.5% for this year.

MAS to loosen slightly?

Singapore’s PMI for new orders, taken together with declines in Sep’s PMIs in key Asian exporting countries, suggests a weak 4Q12. Given the growing risks of a recession, the chances of monetary easing have increased. However, considering the inflationary bias inherent in the government’s policy of restricting foreign-labour inflows, the MAS is likely continue with its policy of a “modest and gradual appreciation of the S$NEER policy band” with no change to the width or the mid-point of the band. But it may also choose to fine-tune its policy by opting for a gentler slope of the band, to 1.5-2% from about 3% currently.

Advertise

Advertise